Summary: Broke many rules and got profoundly f-ed. My confidence and belief in my ability to make it are obliterated, yet again. Red day, down by 9%. Account balance $485

The rules I broke today:

- I traded not a clearly defined setup. The stock broke a downtrend, or so I thought. So what. What was my edge? Were there longs trapped? No. Was there a selling pressure on the tape? No.

- I stayed way longer than I should have. Why? Hoping for. miracle at clearly visible uptrend? Waiting for the trend to change? Seeing volume pushing the stock higher and still staying short? Why? Only to lose more?

- Entering the same absent setup a second time. WTF !!! And then staying in for a whole f-ing day only to close a 9% account drawdown. Fuck me in the brains!

- Was there a rule I didn’t break today?

My problem is not that I cannot clearly see a setup. It is not that I cannot read the tape. It is not that I cannot execute. It is the lack of discipline and disrespect to my rules. It is a personality problem, not a knowledge problem, not a resource/tools related problem. It is me being childishly irresponsible and undisciplined.

How to fix myself?

Have a checklist for the setups.

Have a checklist for the rules.

Fillout these checklist daily.

Track performance based on rules and setup criteria, not based on account value and profit. Track leading indicators, not lagging ones.

To do:

- Define the 2 setups I am allowed to trade. Write down the criteria as a checklist. Have the checklist filled out for every trade.

- Write my trading rules as a checklist and fill out the checklist daily.

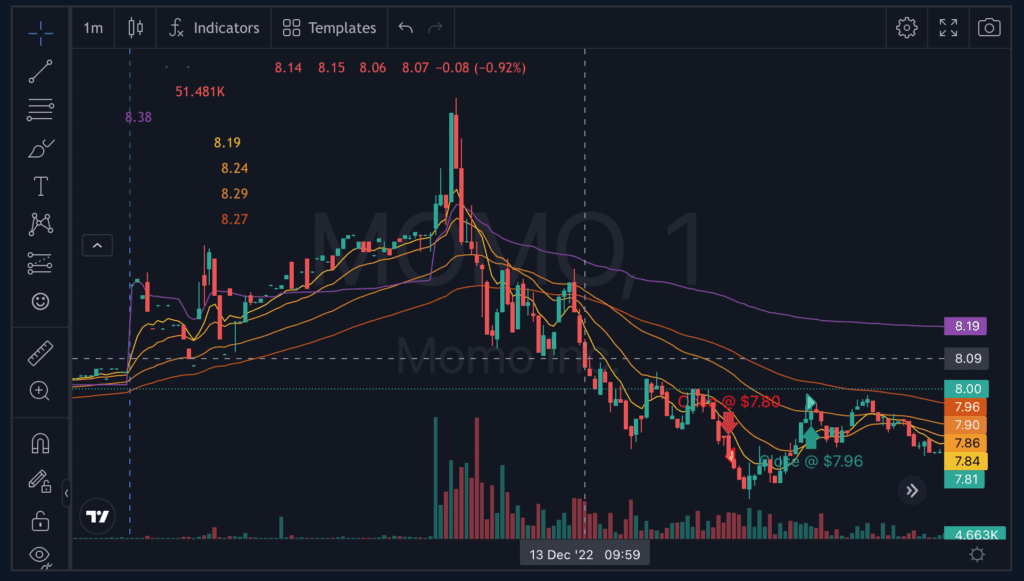

MOMO

Short:

| 12/13/2022 | SS | MOMO | 90 | $7.80 | 10:27:39 | $0.99 |

Cover:

| 12/13/2022 | BC | MOMO | 90 | $7.96 | 10:43:36 | $0.99 |

Stoploss: 8.00

Target: 7.6

Expected R/r: 1/1

Actually tolerated risk: 7.96

Profit/loss: -0.16

Actual R/r: – 0.8/1

Comments:

I entered at the end of the move. I waited for it to clear too many support levels. Instead of clearing support, I must trade on clearing trend lines and based on tape.

Then, I had a chance to lock in some profit, around 10c, but I waited too long.

Also, the exit could have been 3 min earlier when I saw the ABCD forming and the stock making higher lows. An exit at 7.85 would have been completely possible.

Main takes:

- Trade on breaking trend lines to be in earlier, not on breaking support.

- Always draw your trend lines – 5 min and 1 min lines

- Have your hotkeys fully active and use them for exits

Ticker:

Long:

Sell:

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take: