Summary: 1.7% green

I have no room for red days, which elevates my fear to levels where I lose control over my emotions and my brain stops functioning properly. Three trades exhausted me so much, by noon was not able to do anything more for the whole day, I was totally depleted from energy, I felt sick and burnt out.

It was a $9 green day. It isn to that I cannot lose $50 or $100 or even blow the account out (currently at $520). It is just that once I am below $500 balance, I cannot short. I would have to add funds and this will delay the whole process. More importantly, I want to prove I can stay consistently green. This is of such a huge importance to me after failing for so long (since 2019, close to 3.5 years now trading in simulators without being consistent) that the pressure I am under affects everything – my ability to think, my energy, my ability to recover and be productive, etc.

This day started red, with a small well controlled loss (or should I say I was quite lucky the stock didn’t immediately shoot up by $2 and gave me a bit of time to get out dry). Then I recovered emotionally and managed to score a win. The third trade was just an unnecessary scalp without much of setup, just an inertia entry. I must kill this old habit by getting into an entry inertia – going for more and more trades without setup, driving under an adrenaline junkie state of mind. Before the third entry, I was up by around $21. After it – only $9. Really painful. Same lessons over and over again. I hope they sink in eventually: Do not enter without a setup, do not trade stocks that are not on a high relative volume, do not overtrade, monitor your emotional state and if you detect the adrenaline junkie, fire him, get off the desk and turn off the pc. Same lessons repeated thousands of times.

Main takeouts from the day:

- Do not overtrade

- Constantly monitor your state – do not let the adrenaline junkie take over

- Constantly monitor support/resistance levels and trends forming and being broken so you can have better entries.

- Take the time to set your hotkeys for the short side

- Be better prepared for every stock you are watching – what are the fundamentals, chances of dilutions, cash strapped?, what is the general feel of the tape

- Trust your thesis once you have it. APVO was a great example of me coming with the right thesis, but not trusting it and therefore executing poorly and overcautiously

- Stop being scared. The worst that can happen is you blow out the account. Once you accept that, you can be more focused and in control. I am not saying to go ballistic and trade with the “Let’s see what can happen here” attitude, the “scientific” attitude experimenting with “smart ideas”. I am talking about being in control, not letting fear guide me and incapacitate me.

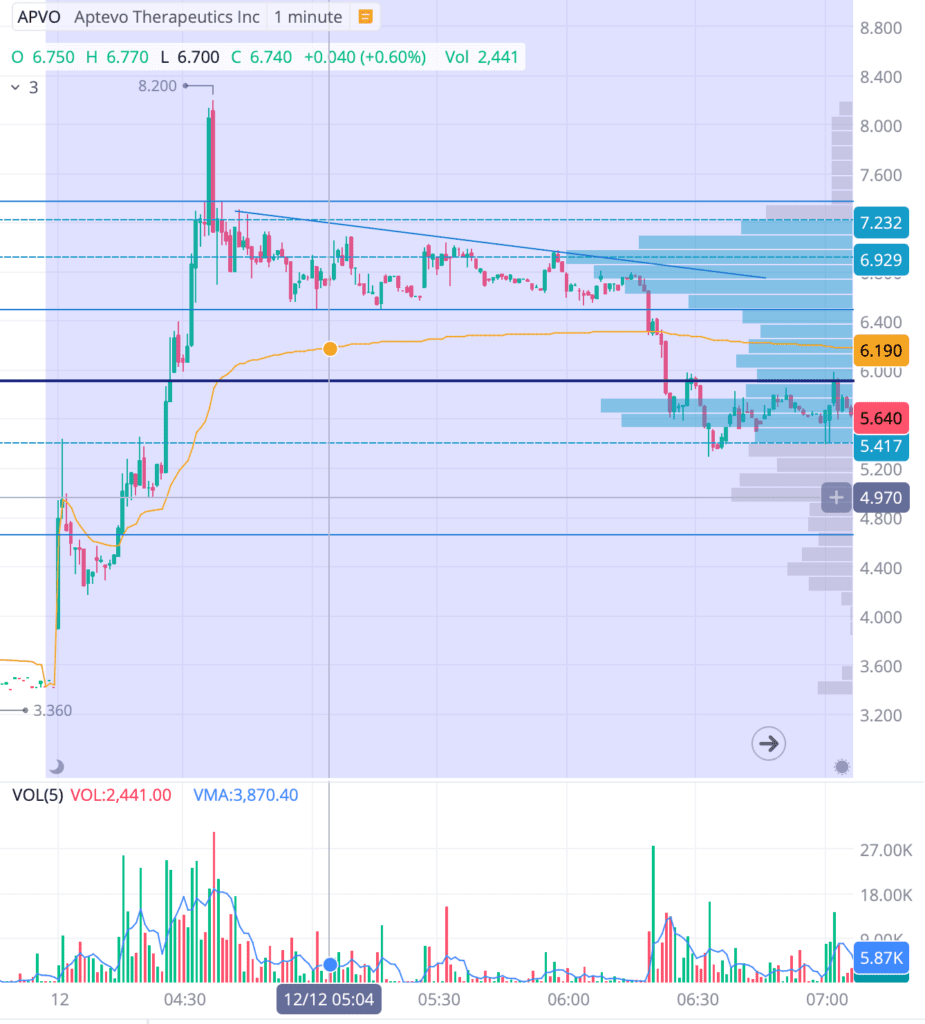

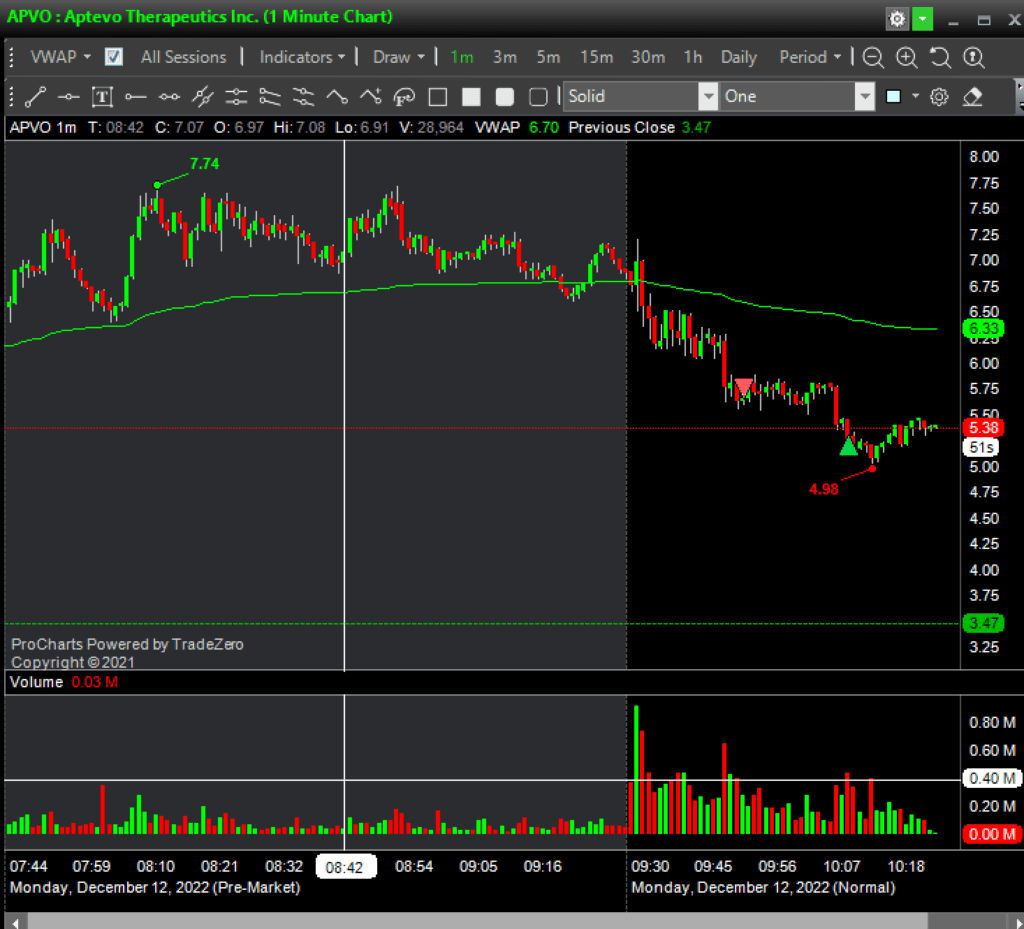

$APVO 6c loss, full size

Short

| $5.69 | 06:24:26 |

Cover

| $5.75 | 07:01:11 |

Stoploss – 6 was the ultimate stoploss, with the VWAP boulevard at 5.94 helping too. Too deep of a stoploss, too far!!!

Target was 5, worst case 5.45 (after hours highs).

Tolerated risk – 5.99, 30c or 5.3% – VERY HIGH RISK tolerated !!!!!

Expected R/r – 1/1 conservative, 2/1 ideal. The stock did not give a 2/1, but 1/1 was quite possible.

Max possible profit – 5.35, 31c, 5.5%

Max possible R/r was 1/1 not great.

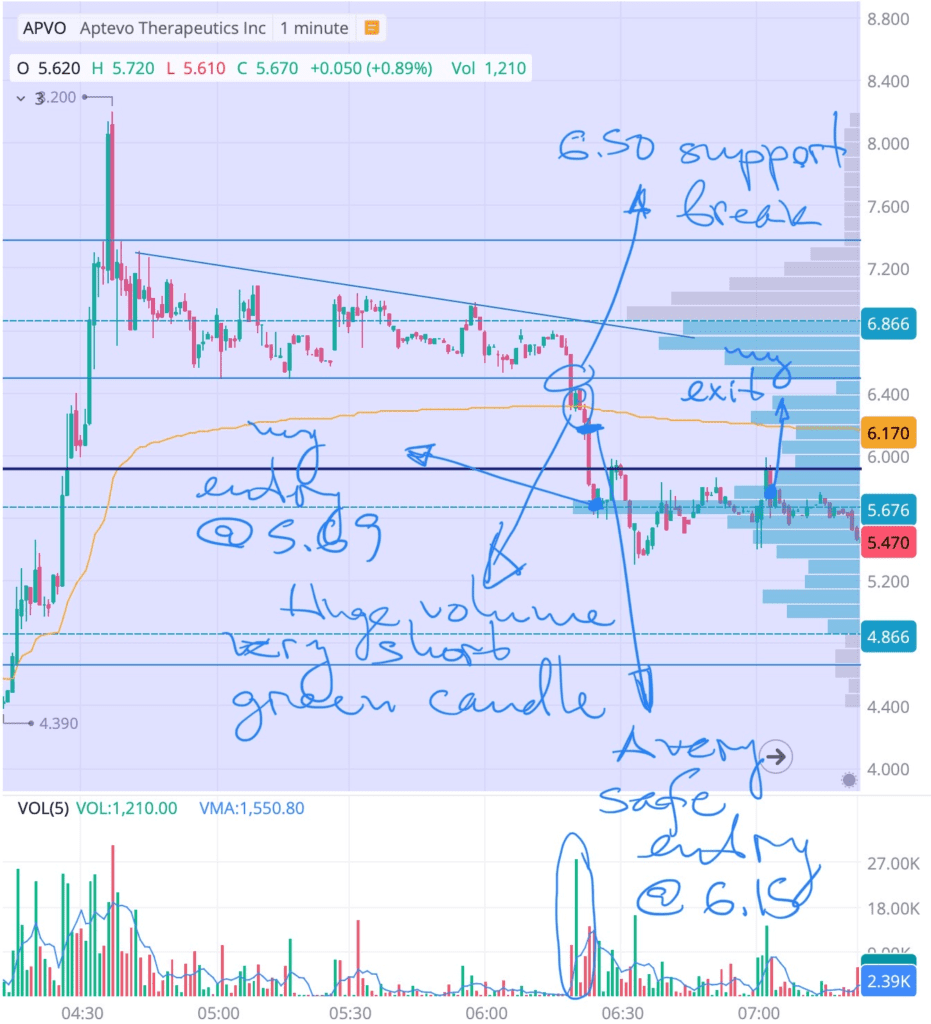

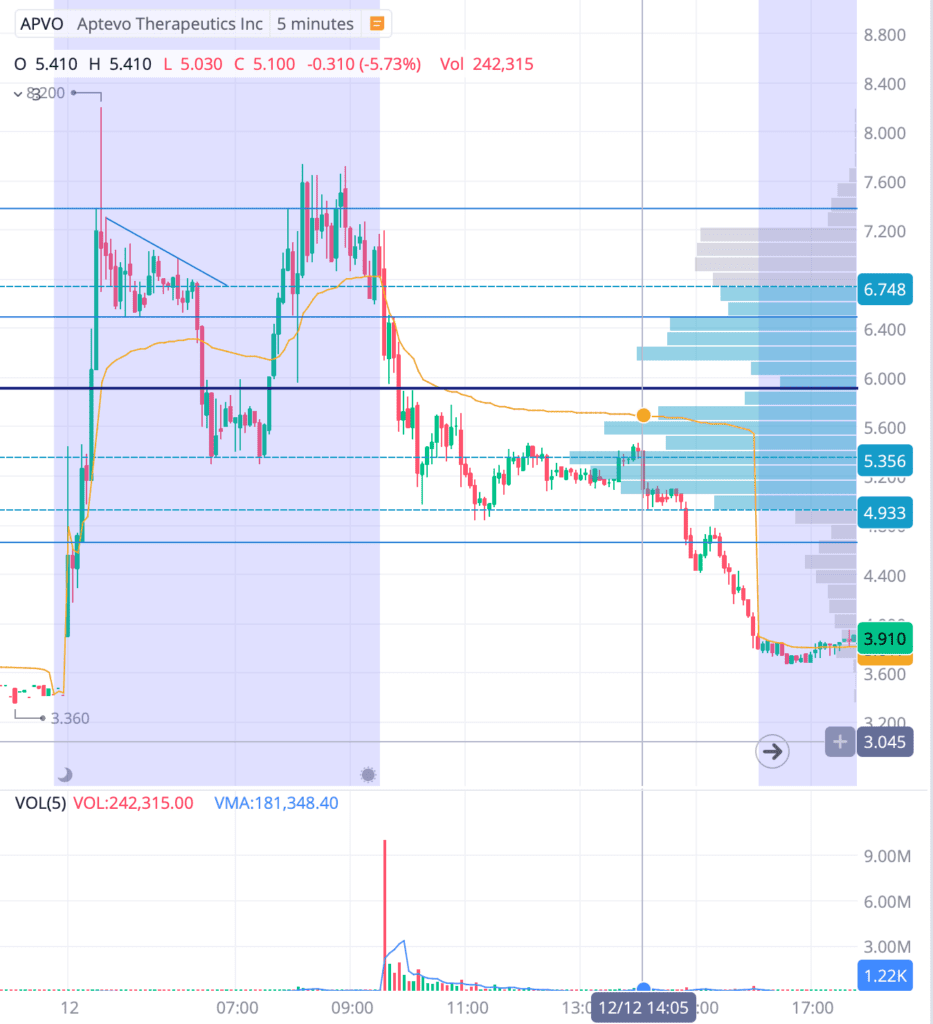

Looking at the chart post factum, I have had a way better entry earlier at around 6.15, after it broke the 6.50 support and had this very short huge volume green candle indicating shorts are not in control (the continuation is red). Moreover, at 6.15 it has already broken the VWAP. Mind you, it was a well rigged stock, so even then it might have felt a bit risky. Only an hour later, at 7:30, it went back to 7.40, breaking the VWAP resistance in 5 long candles.

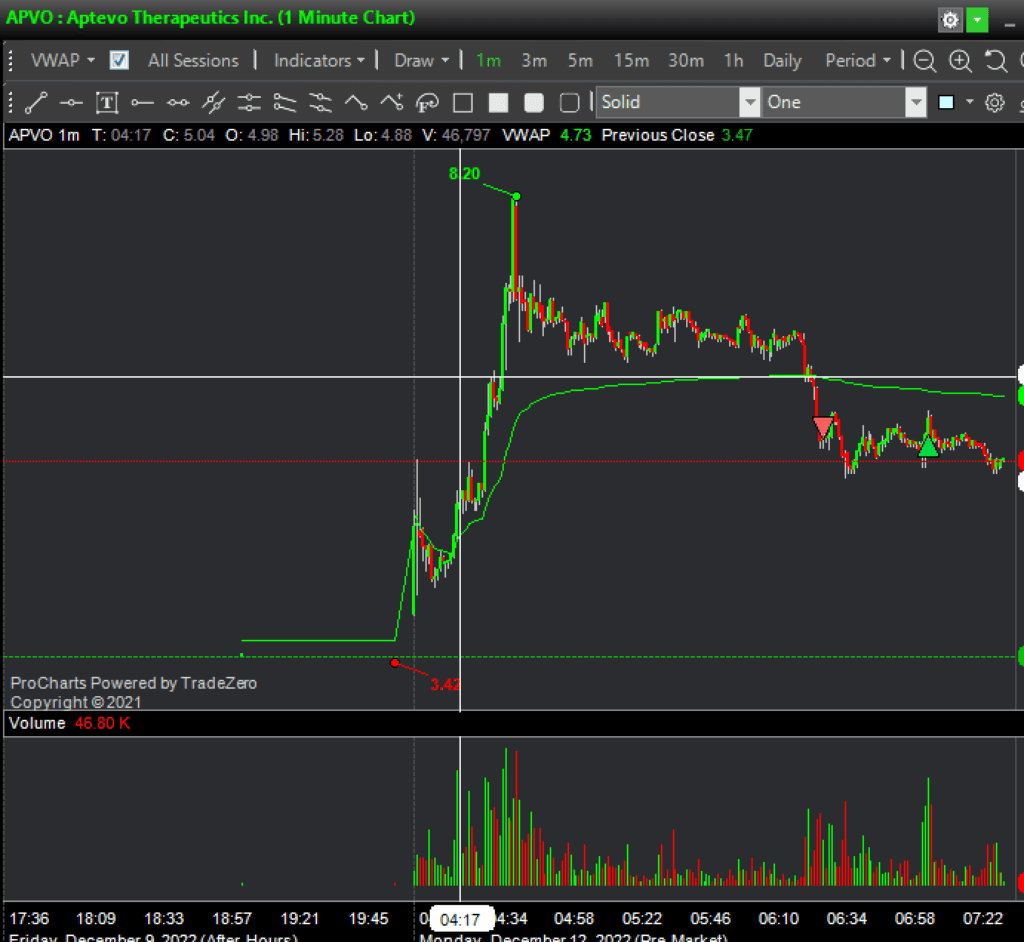

APVO 35c gain, full size

Short

| $5.65 | 09:49:23 |

Cover

| $5.31 | 10:07:56 |

In retrospection, I have had a safe and better entry 5 min earlier at around 6.25 when it started holding it as a resistance level. That’s 80C F-ing cents higher !!!! I only made 34c on this one, I could have grossed a $1. I was scared as shit with no room for a red day. My account is a micro-size – $520. If I go below $500, I can’t short. Until I bring it up to around $1,000, I will have no room for errors and negative trades. Which triggers the rightful question: WHY THE F>U>C>K> DID I MAKE THE NEXT TRADE??????

Major take from this trade – have your support/resistance and trend lines in front of you, update them as often as you can, search for the highest possible safe entry with a good stop. Do not wait for the move to be over.

APVO gave another excellent entry at 14:05. You must listen to what AllDayFaders say. Come back at 2pm for the Blood Bath. Well, I wasn’t around then, too exhausted from shitting my pants with fear and panic in the am on these miserable schmuck trades.

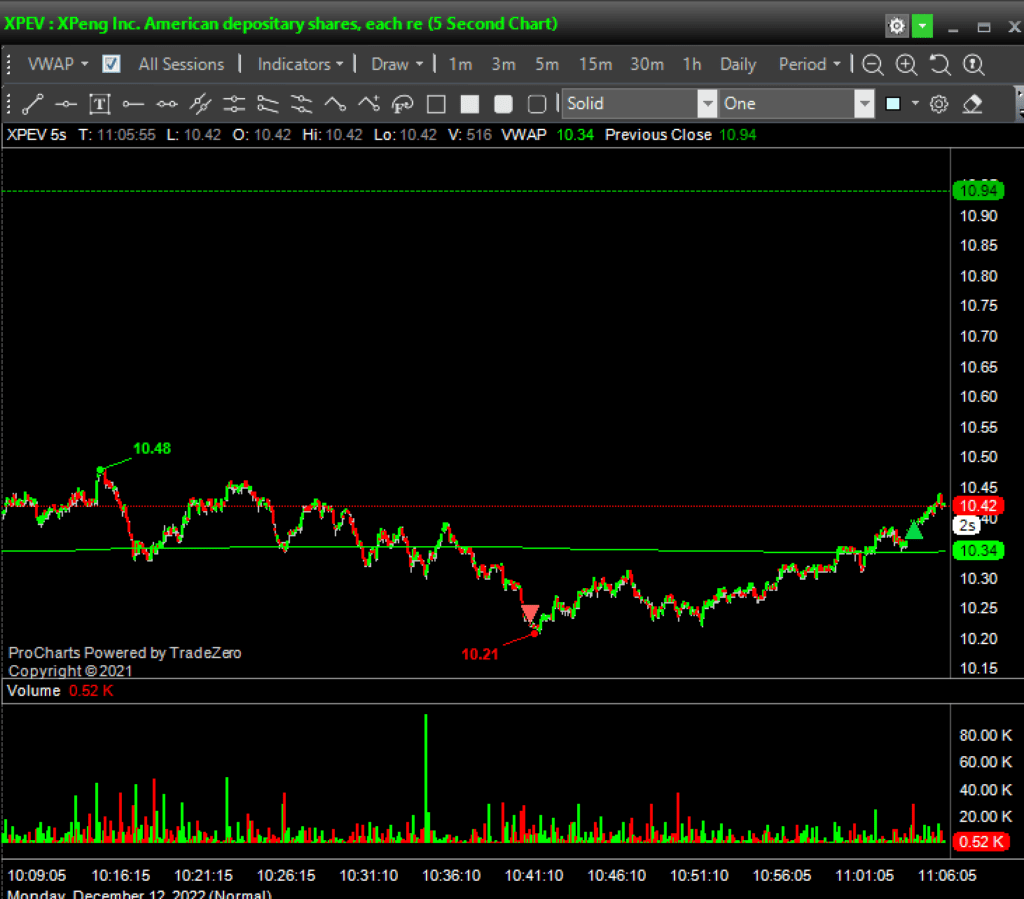

XPEV 18c loss, half size

Short

| $10.22 | 10:40:54 |

Cover

| $10.40 | 11:04:02 |