UNDER A TRADING REHAB !!

I AM UNDER STRICT REHAB RULES UNTIL I PROVE CONSISTENCY

REHAB RULES:

1. TRADE TWO SETUPS ONLY.

2. DO NOT TOUCH ANYTHING THAT IS NOT AN “A” SETUP

3. GET OUT OF POSITION AT THE FIRST SIGN THE TAPE IS AGAINST YOU OR IF YOU FIND OUT YOU MADE A WRONG ENTRY. NEVER MAINTAIN A POSITION HOPING.

4. IF A STOCK IS NOT GOING IN THE RIGHT DIRECTION WITHIN 5 MIN OF YOUR ENTRY, LEAVE THE POSITION AT FIRST OPPORTUNITY.

5. MOST IMPORTANT: HAVE A CLEAR DEFINITION OF AN “A” SETUP

Summary:

There is an IMMENSE difference between knowing what to do and doing it.

Main lesson for the day

- How to learn to do what I know is right?

- Use the methods you know – Joe Dispenza’s methodology on changing identity visualizing a new me with intense emotions and for prolonged period of time, ideally throughout the whole day with eyes open.

What can I turn into a system/procedure/habit/tool so I save time and eliminate decisions?

Develop a specific levels plan for a stock to trade it. Identify the key level out of which you want to go for it.

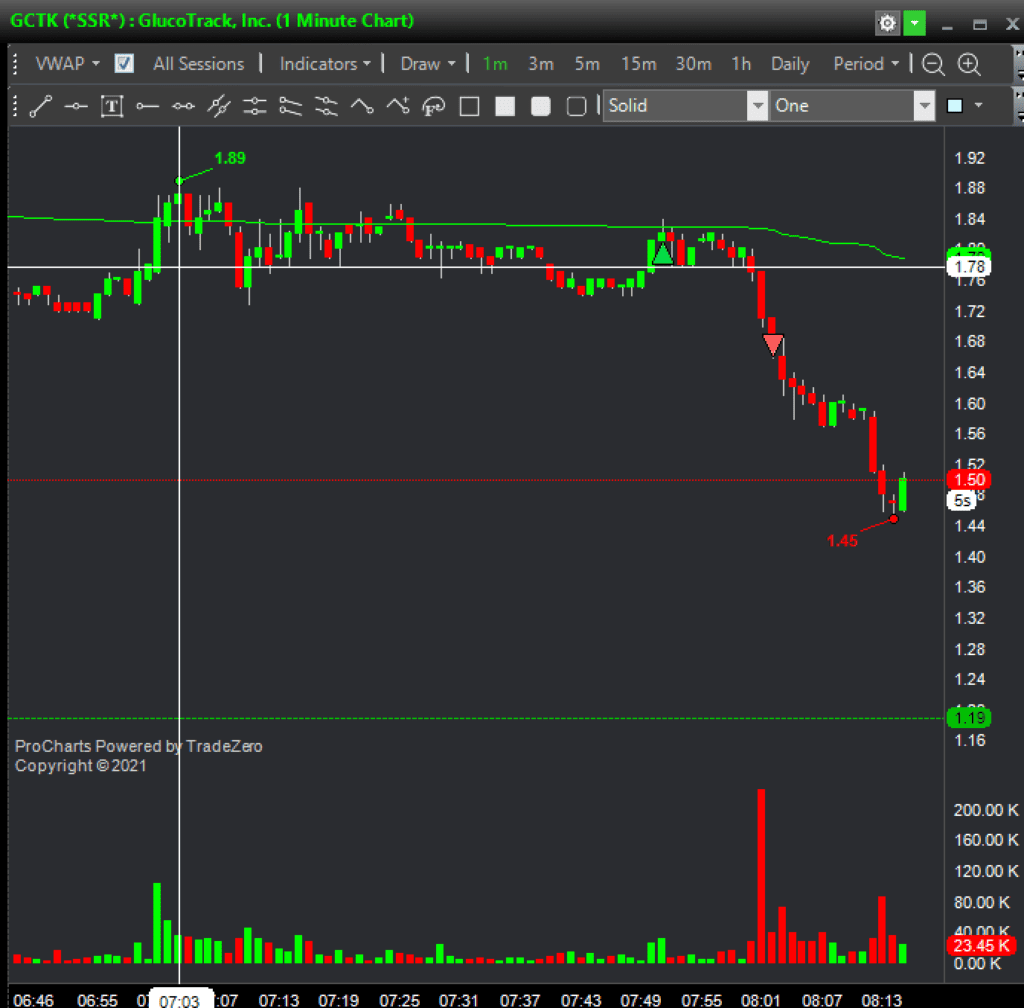

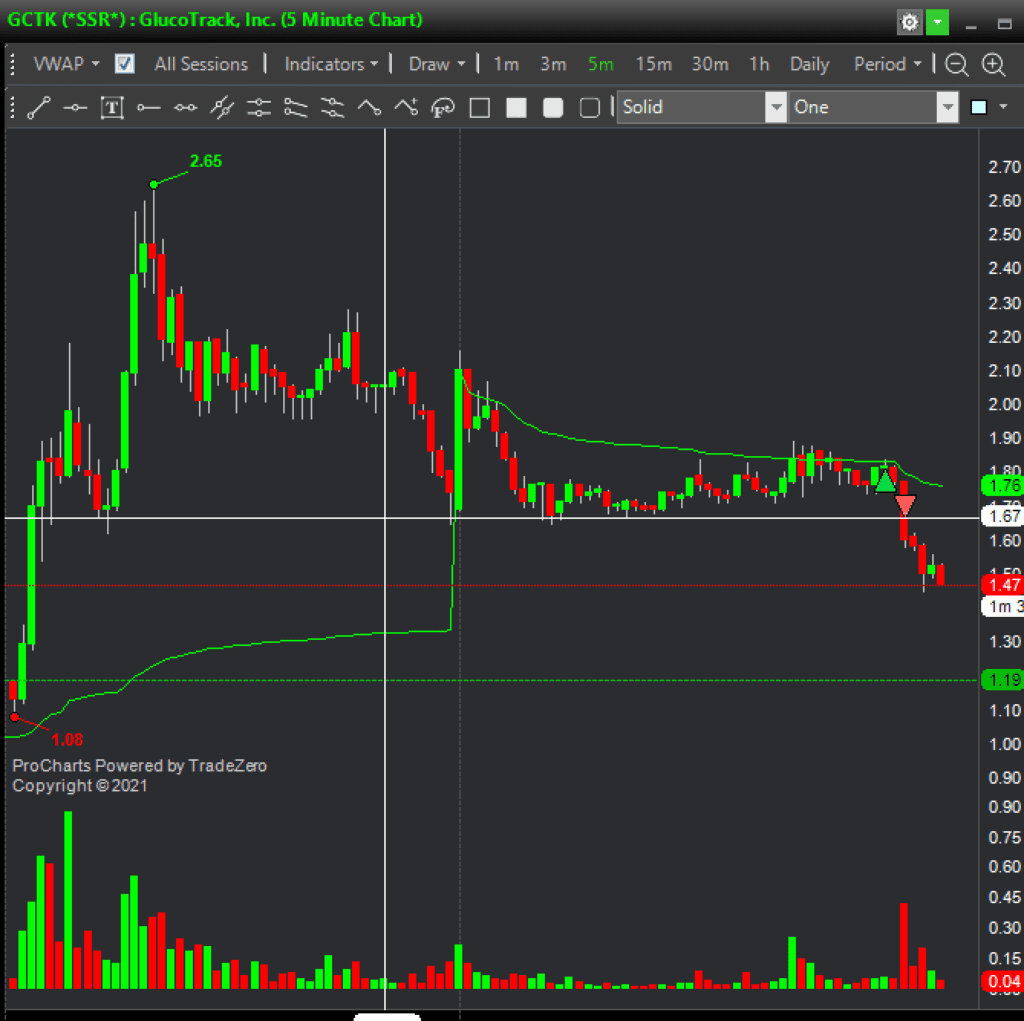

Ticker: GCTK

Long: 1.81

Stoploss: 1.77

Target: 2.18

Expected R/r: 8/1

Actually tolerated risk: 8.3%

Profit/loss: -0.15

Actual R/r: -4 (when loss, how much times bigger the actual loss is based on the expected expected loss)

Comments: This is my first trade since ages. My account is down to $180. After this trade, down to $160. I don’t know, it is kind of discouraging all this shit.

Main take:

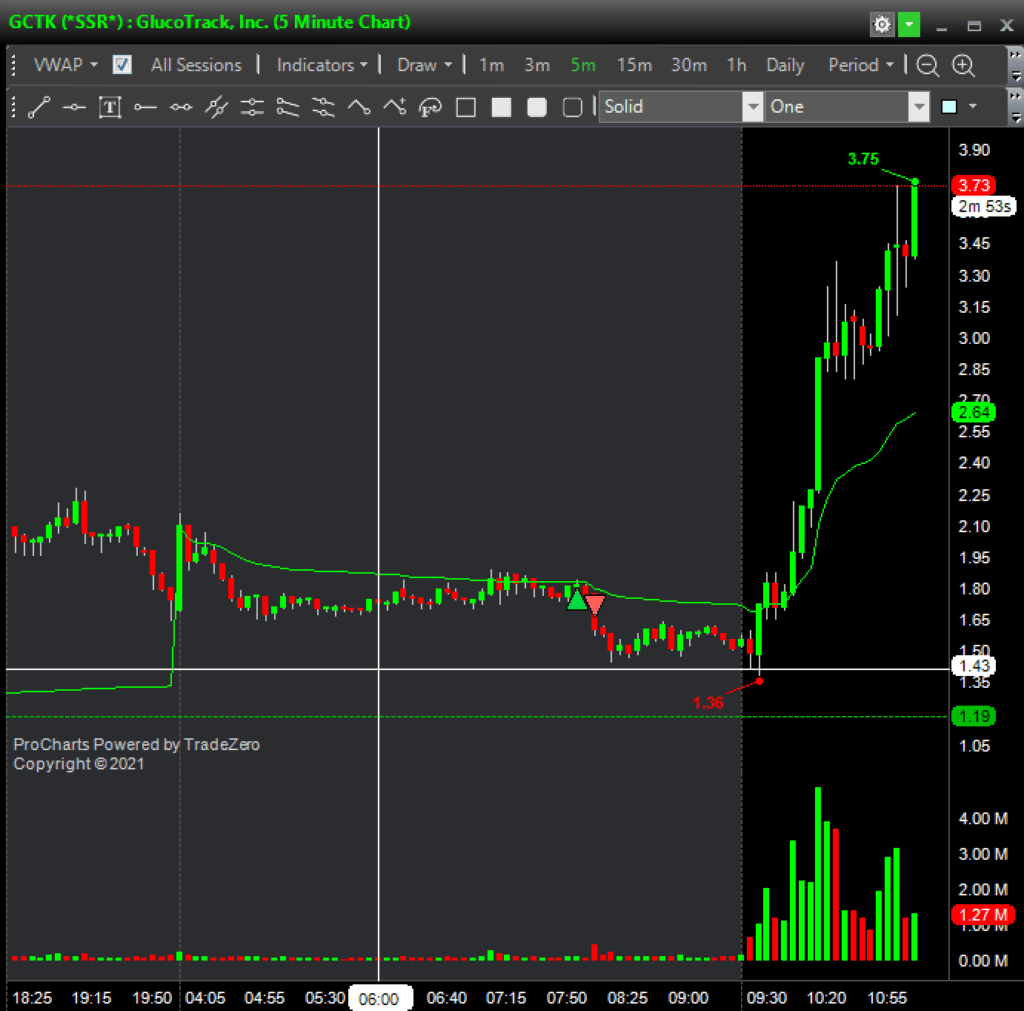

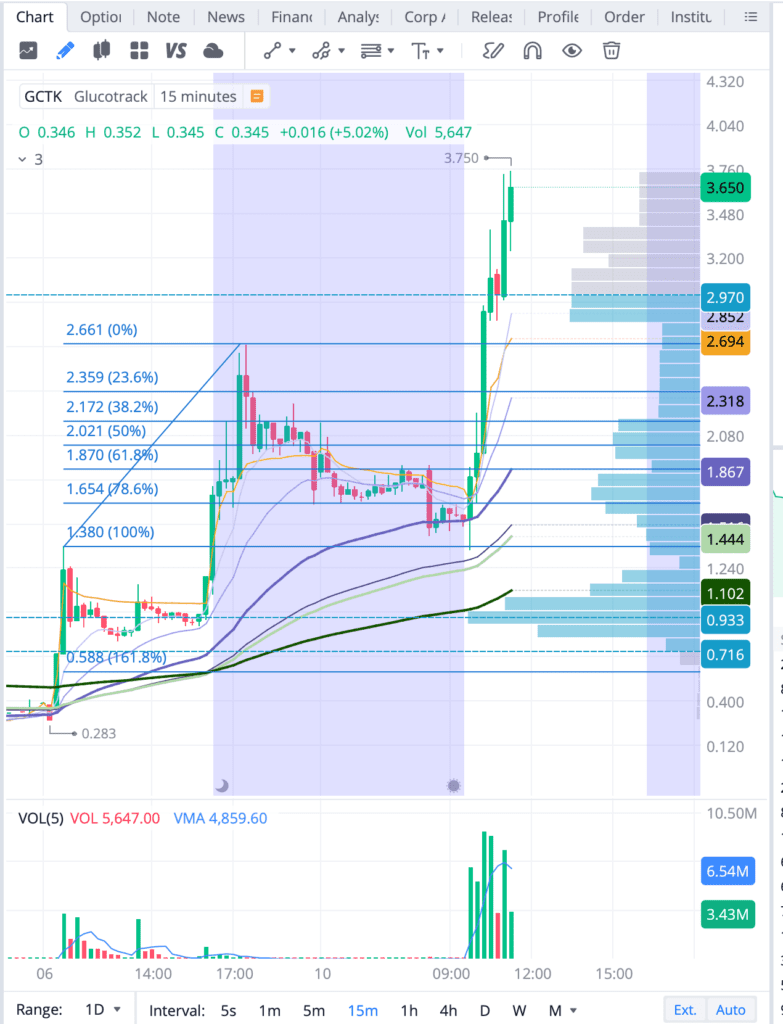

- It is the first time I am trying to fit the Fibonacci retracement from the last top back to whatever key point works with matching the levels. It turned out in this case, the previous day high was the starting point for the retracement and the levels were matching quite nicely, literally ALL LEVELS !!!!! Do this again with other stocks in play.

- I did want it to retrace back to the previous day high and then enter. I did expect it to happen around opening or a bit after. It did, it touched the PDH and immediately spiked up. That critical level was also the 5-min 200EMA !!!!

- I do know what is the main setup to wait for. I just am not patient enough and when it plays, I have already lost on the stock and am not confident enough to play it.

- I had the confidence to ignore all other stocks in play. I know where was the biggest potential for the opening.

- I hope I can act next time on what I know is the right setup, not on the warming act to it.

Ticker:

Long:

Sell:

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take:

Ticker:

Long:

Sell:

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take:

Ticker:

Long:

Sell:

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take: