Long low float momentum scalper

He started trading in March 2022, lost $9,000 in a single trade because of averaging down and the absence of a stop loss. Since then, he recovered and is now full time trader managing a large and a small account. In the large account, he often goes in with a few thousand shares. A big hearted guy, sharing with the community and contributing at a scale.

Step ZERO: PATIENCE (always read the chart/candles nothing else)

Step ONE: identify the right stock – $2 to $8 priced low float on good news and high relative volume

Stock description from his rules:

- Float nothing above 80 million

- Established Top volume / Percentage gainers

- Low spread

- Stick to 1 or 2 per day

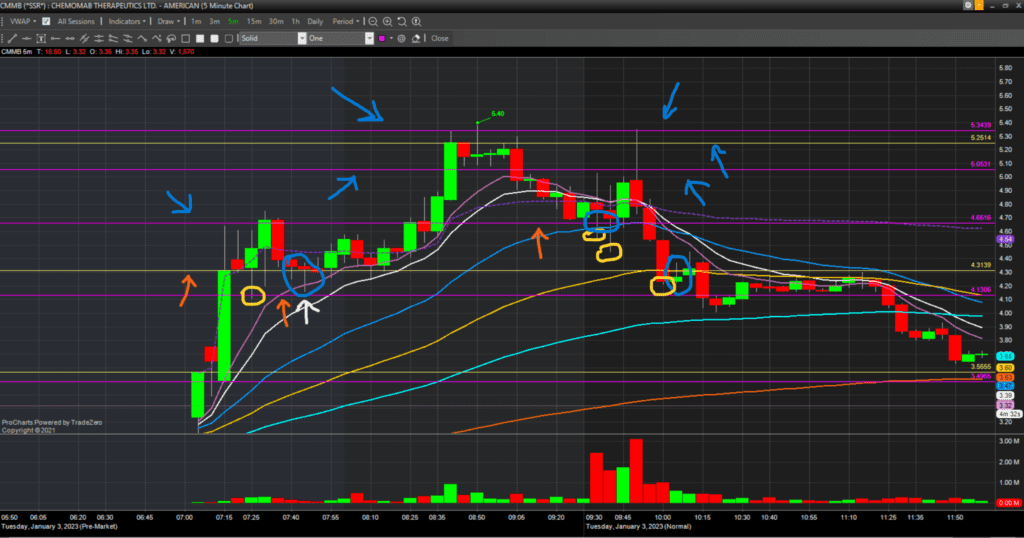

Step TWO: identify critical levels on daily and 1h or 4h charts in purple and also 5min big candles and pre-market high from today in yellow

He often doesn’t use the top of the wick, but rather uses the close/open of the daily and 1h candles to define levels. There is more to learn bout setting key levels.

For the intraday levels (the yellow horizontal lines), he uses the close of long 5min candles (not the tip of the wick!).

Step THREE: identify key trend lines on the 5min and 15min charts

Step FOUR: Play only 3 setups – Higher Highs and Higher Lows (HHHL), Double bottom and Reversals. Enter only at a confirmed support on the 5min chart. How is support confirmed? By the confluence of a few factors:

- The chart demonstrates support by respecting one or a few of the following: the larger timeframe trend line, 8/12/26/50/89/200 EMA, daily and intraday support/resistance levels, levels based on long 5min candles

- The price action confirms support with bullish candlesticks and candlestick formations. His favourite is the hammer on the 5min (the middle red candle in the blue circle on the left in the chart above)

- He says he doesn’t read well LV2, but he does use it to see large bidders or sellers and how they affect the price movement.

- He uses the 5sec chart to detect how volume confirms support

Entry areas from his rules: tested levels (EMAs/VWAP/Daily levels) / Double bottoms

Entry signals from his rules: Hammer/Doji candles / Consolidation levels / Breakouts (pre-market wall breaking)

Step FIVE: Set stop at the wick of entry candle or the below consolidation area, never more than 3% of the account balance.

He often manages to enter very close to support so his risk is really tight, 5c to 10c usually. His stop is a hard stop almost always.

Step SIX: Take profit on big 5min candle / Resistance levels (Intraday/Daily/VWAP).

He used to take profit with up to 80% of size at the first 10c

Step SEVEN: At the end of the day, check trades against the rules and adjust as needed.

How he describes his trading style

He identifies his style with this video:

He also very often refers to this Valckrie (https://twitter.com/Valckrie) post on Reddit:

Dae says Valckrie is the only trader he follows and who helped him become profitable.