UNDER A TRADING REHAB !!

I AM UNDER STRICT REHAB RULES UNTIL I PROVE CONSISTENCY

REHAB RULES:

1. TRADE TWO SETUPS ONLY.

2. DO NOT TOUCH ANYTHING THAT IS NOT AN “A” SETUP

3. GET OUT OF POSITION AT THE FIRST SIGN THE TAPE IS AGAINST YOU OR IF YOU FIND OUT YOU MADE A WRONG ENTRY. NEVER MAINTAIN A POSITION HOPING.

4. IF A STOCK IS NOT GOING IN THE RIGHT DIRECTION WITHIN 5 MIN OF YOUR ENTRY, LEAVE THE POSITION AT FIRST OPPORTUNITY.

5. MOST IMPORTANT: HAVE A CLEAR DEFINITION OF AN “A” SETUP

Summary

Another fuckup, this time just smaller, only $11 loss fo the day.

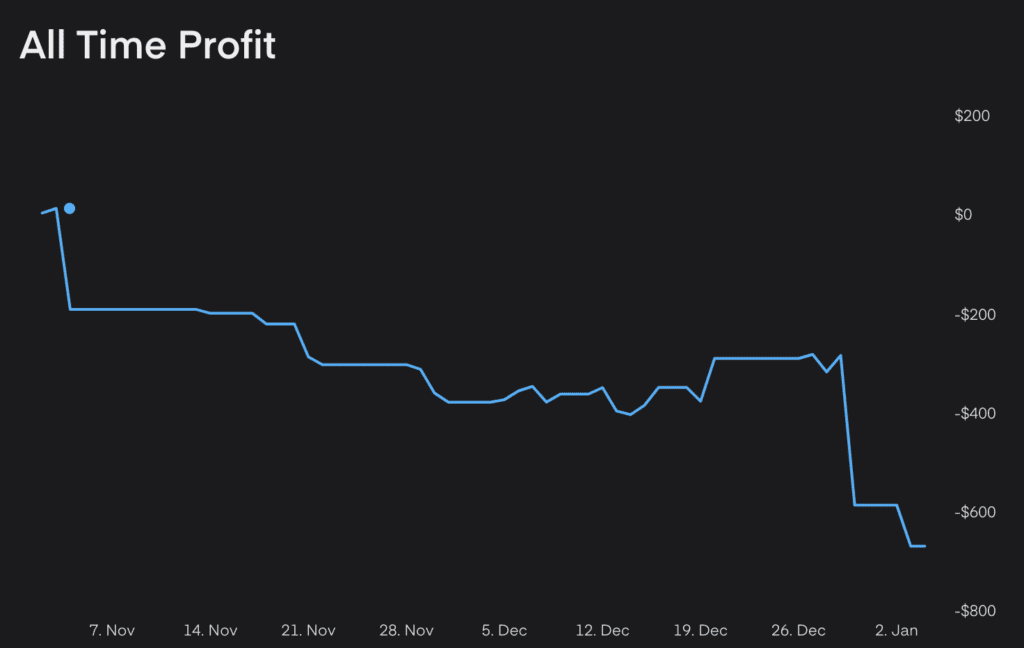

My previous 2 days of trading, the 30th Dec and the 3rd of Jan literally erased 55% of my account going down from $820 to $395.

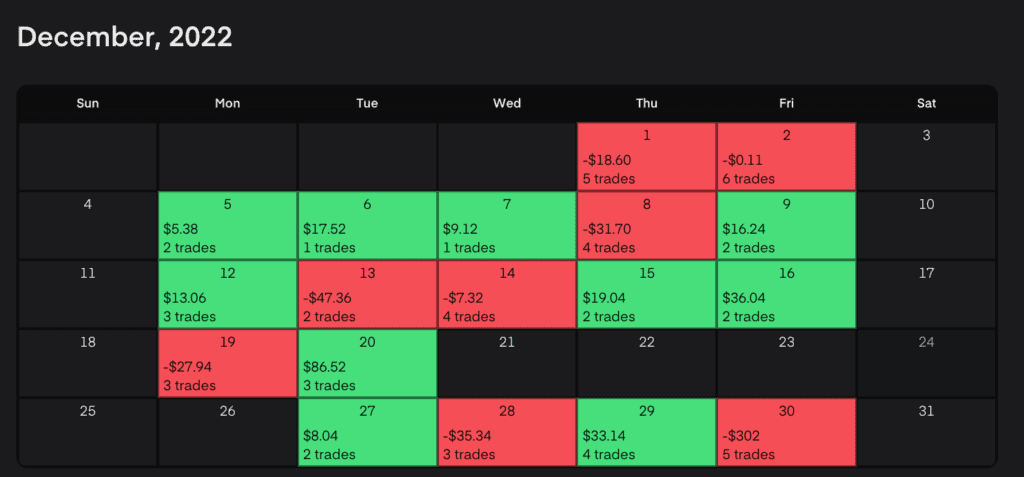

Here is my December calendar:

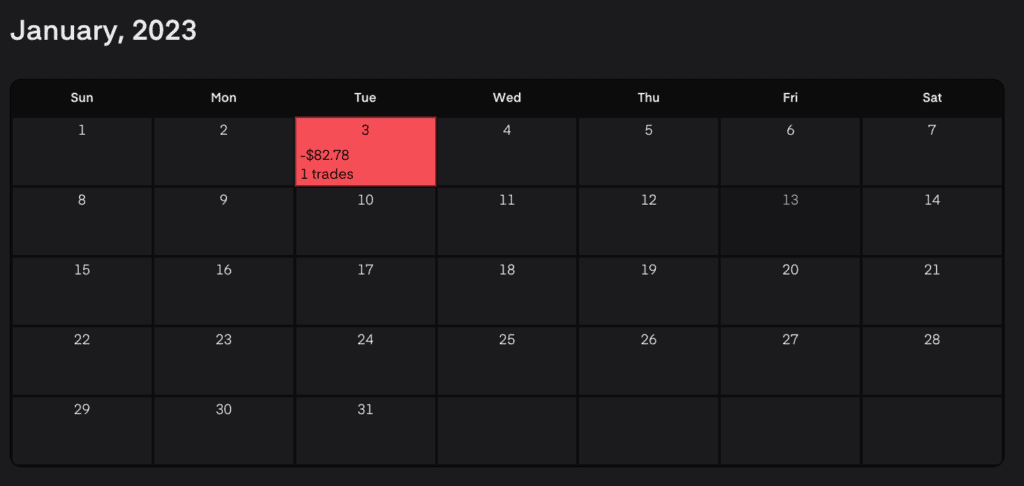

Here is how I started 2023:

And my all time account progress:

After such a finish of the year and beginning of 2023, I feel totally destroyed. My confidence is non-existent, my hopes to make it as a trader are in negative values. I have put soo much of time and effort in this to make it work and yet, I am behind square zero. Behind, because when I started, my hope was high. Today, I feel as the biggest failure ever with no hope that I would ever make it.

Main lesson for the day

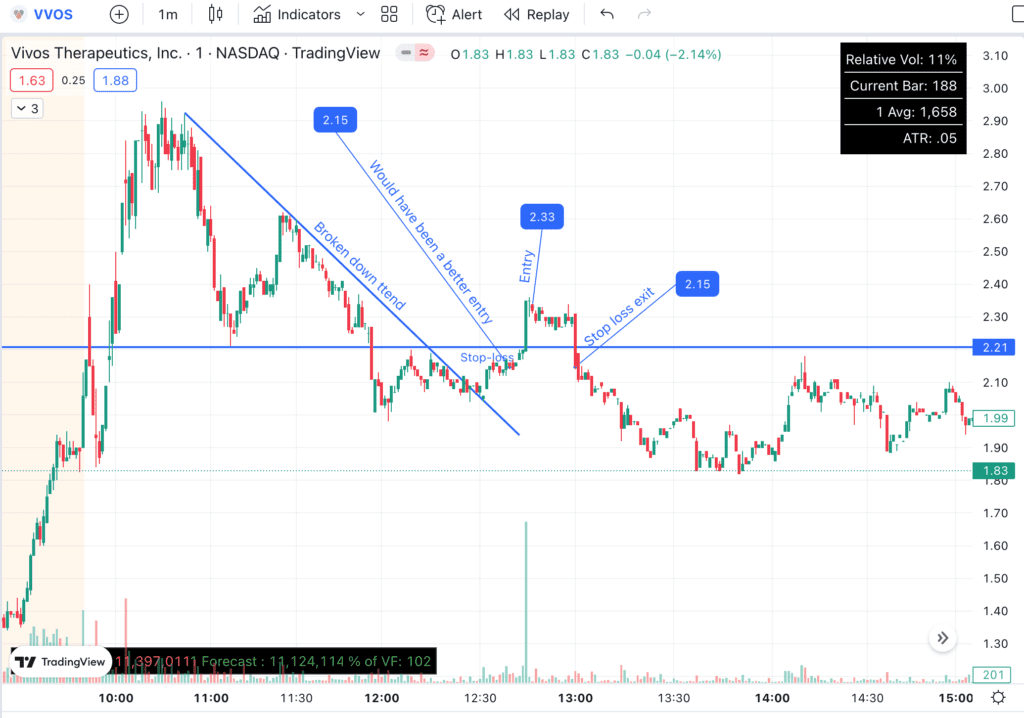

Today I waited long enough for a good setup. Finally it came, but what I underestimated was that most volume was stolen by KALA, while I traded VVOS. VVOS was still the number one gapper and on top of scanners, but this wasn’t enough. My second mistake was that I didn’t go out once I saw there was a huge supply at 3.34. I waited in position for a bit too long.

What can I turn into a system/procedure/habit/tool so I save time and eliminate decisions?

VVOS

Long:

| 01/04/2023 | B | VVOS | 50 | $2.33 | 12:47:00 | $0.99 |

Sell:

| 01/04/2023 | S | VVOS | 50 | $2.15 | 13:00:58 | $0.99 |

Stoploss: 2.21

Target: 2.60

Expected R/r: 3/1

Actually tolerated risk: 2.15

Profit/loss: -0.18

Actual R/r: -1.5/1

Comments: We had a broken down trend plus an ABCD pattern. In general, it was not a bad setup. A few things that might have hinted towards weakness – KALA had stolen the volume from VVOS making it second highest volume at the time. Then the 1-min candle with close to 1M volume had no following high volume candles. It was the highest volume candle for the day, yet volume went back to previous levels immediately after it. Noticing this volume behaviour and the strong resistance at 2.34, I should have moved my stop below the consolidation at around 2.28-2.30.

One other mistake I made: I didn’t have a hard stop loss, so when my mental stop was hit, it took me time to make the sale order work.

Main take:

- Sometimes setups would not work.

- Backside of the move carries a higher risk

- Always have your hard stop active!!!!