The key factor when it comes to all day faders is and will always be ITM dilution. Keep in mind that this is always relative to the stock’s volume. 5M dilution means nothing if volume is 100M. That’s where ppl fuck up b/c they look at supply but ignore demand #BearTipOfTheDay

If there is no dilution, then most of the selling will obviously come from bagholders and profit takers. The more overhead resistance (from previous big volume days, followed by VERY low volume days), the more bagholders. And the more extended the stock is, the more profit takers·

Replying to

Dont count on shortsellers to provide most of ur supply. In fact most of the best faders ive seen, tracked & traded had the LEAST amount of shorts on that day. The more shorts involved, the more covers on the way down. slows down the descent. leads to cunty/choppy fades.

·

Replying to

Exactly right. Short sellers = natural organic bids That’s why easier to borrow stocks of lower floats causes the biggest squeezes

1

1

15

·

Replying to

absolutely. most of the time, tiny float + ETB is like having a 10/10 chick you’ve never seen, suddenly walk up to you and beg you to fuck her. … i probably will anyway but guaranteed herpes.

5

3

26

·

Replying to

and

Jajajajajaj

·

Replying to

Amen

·

Replying to

Yeah, avoid ETBs like the plague.

Replying to

What makes your conviction strong that they will dillute THAT day, instead of running it up multidays before dumping. If they have the option + vol to pull it off. First green day faders is somthing I’m still working hard to figure out.

from Florida, USA

·

Replying to

and

Use price action / break of key supports as confirmation. You don’t need to find the top.

1

·

Replying to

and

That indicates dilution, there is no 100% guarantee. Also, recent 424b, active shelf etc, followed by fluff news to boost price.

·

Replying to

and

Nobody knows when. One thing for sure is that it’s there that backs up your short thesis.

·

$MRIN current reality: Someone CLEARLY has the float on lock. Pullbacks are on pussy volume, so no real distribution yet. Currently the strongest leading stock. Zero dilution. Yet, somewhere out there, a shortseller is trying to find the top on it. Mindblown.

·

If the setup is AMAZING, so >90% ADF score plus everything else I look for (low institutional ownership, ton of dilution, VWAP of previous big vol days etc.), then yes sometimes I make exceptions and let the broker molest me a little (just the tip of the penis though, no further)

YBZ59

@YBZ59

·

Oct 29, 2020

Replying to @team3dstocks

The question is, will you pass an A+++ just because borrows were so expensive? is there a threshold/mark you won’t cross?

Remember, a stock manipulator only fears 2 things: 1) liquidity: without this, they CANT size up & manipulate the stock higher. 2) dilution: they are TERRIFIED of intraday/overnight offerings. High volume + no dilution/ability to raise = ALWAYS be on guard.

The dilution is not just to make it drop fast. Stocks can tank hard without it. The dilution/shelf is to DISCOURAGE the buyer from holding SIZE overnight. It terrifies them. But without it, they have a free pass to sodomize us. So i still short, but w less size or stricter stops

Quote Tweet

Stan Gluzman

@CiocanaTrader

·

Jul 28, 2018

$AWX hope everyone stayed safe and cut losses. I sure did. Of course lots of accounts have blown up. As @team3dstocks said- there is no dilution in there, so it’s not gonna drop easy. Between that and $GBR- gave back huge. New rule- avoid non dilution, go heavy otherwise ($HMNY)

·

Replying to

All pumpers have a SPECIFIC fundamental checklist that they go thru b4 they buy up the float. They dont blindly pick random stocks. It’s a risky endeavor so they wanna limit their risk as much as possible. I use that same checklist to find the best shorts (i invert the criteria)

5

8

59

·

Replying to

traders are lazy af and I wouldn’t be surprised if 80%+ never even bother to look through filings. Especially in small cap land.

3

·

Replying to

save thread

1

·

Replying to

First public save of this thread!

Readwise users: Like this reply to save team3dstocks’s thread to your account without cluttering their replies Stats: • 19 total saves of team3dstocks’s threads (ranked #1313)

·

Replying to

Unless if the stock manipulator IS the one coordinating with companies to move stocks to get the offering sold. Which usually is the case.

1

9

·

Replying to

Yup. and in that case you see them get out hours, sometimes minutes before the offering, as they let bent over shorts continue the prop job for them. classic.

1

3

·

Replying to

like $BPTH just now? lol

1

6

·

Replying to

lol yup.

Exactly. Bulls who dont study short setups keep buying extended trash right into resistance or scam companies FULL of dilution, then when they get bagged they cry “sHoRtSeLlErs aRe eVil. sEc wheRe aRe YoU?”. no motherfucker u need to quit buying fecal matter

Quote Tweet

ILTrader

@trader_il

·

Jul 15, 2021

Replying to @team3dstocks

And the opposite for bulls, need to learn short setups

·

Replying to

What i really dont understand ethically why would some short attack good companies and destroy their work i would understand it if there is a study that this company has faults but to attack any company for me is not a good thing to do.

5

1

·

Replying to

So many crybabies these days. It’s always someone else’s fault.

1

4

·

Replying to

always bro. zero accountability

2

3

·

Replying to

and

This is why I love trading. It is extremely liberating. It’s all on you.. good or bad.

1

2

·

Replying to

and

Right!! We are in competition with ourselves. Master yourself = Master trading

2

·

Replying to

That’s why I set notifications for all of your tweets. When I started, I wanted to get rich quick longing low float runners. I saw your page and thought, “Know your enemy.” 2.5 years later, I realize you’ve been one of the best friends I could have. Thank you for the knowledge.

1

28

·

Replying to

THIS. This changed my trading. Learning the other side of the tape.

It was a crazy year. We started with the death of the Bitcoin runners $XNET $RIOT $DPW $MARA etc., some chinese lovin’ from $CNIT $CNET $CCIH etc. We saw $HMNY give us some $DRYS dilution nostalgia, $LFIN $RKDA $IMTE $ZSAN went berserk, and $AWX $MTSL $GBR said “hold my beer”.

Quote Tweet

AllDayFaders

@team3dstocks

·

Dec 31, 2018

And with these last entries, conclude every single runner of 2018. All 2000+ of em tracked manually & meticulously picked apart each night before bed, to grow as a trader. Time to start a new one for 2019. Yes it’s tedious, yes it’s boring, but as I always say,”Edge is not free”.

·

In low float land, just been watching $TNXP and $TENX for entertainment while waiting for large cap fades to pay out. $TNXP nice offering. damn, i guess those fundamentals do matter huh? nah. that halt + selloff was totally due to the chart. Dilution is a myth. $TENX no shares

5

28

$MRIN loving it. yall keep shorting max BP these no shelf no dilution plays lol it’s not like I warn every day about those. you gon learn today. Anyway go to the moon please. We havent had a 100% runner in over 5 days now. This nanocap market needs some love.

·

Replying to

$MRIN oh and dont get it twisted, im still as bearish as it gets. But ive gotten my balls squeezed long enough to know WHEN to hammer. I only short aggressively when other bears are done getting mauled. Why? b/c i want ZERO bids (covers) on the way down from underwater shorts

1

25

·

$YECO no dilution, no shelf (no risk of getting stuck in an offering while soaking), tiny float = a soaker’s dream lol just like $AWX $MTSL $GBR . these guys are such professionals lol i love it. The only reason to dump now is to avoid filing to the SEC. 2-3pm will be interesting

Quote Tweet

AllDayFaders

@team3dstocks

·

Jul 27, 2018

Those guys SPECIFICALLY go after stocks that have no dilution, & no effective shelves bc they can buy up as MUCH as they want without the risk of the company doing an offering on them after hours. They LOVE those. But whatever. Im done trying to get ppl to respect fundamentals

·

Replying to

The struggle of trying to help ppl on twitter is that its hard to find the balance between helping & protecting ur edge. The more i try to help, the more i give away pieces of the puzzle. I’ll shut up from now on. the less ppl that know this shit, the better 4 us anyway.Good luck

As a shortseller at heart $DRYS will always go down as 1 of the greatest stocks of my lifetime. The glory days of dilution. I honestly feel bad for those who missed that era. the whole shippers bubble along with $DCIX $TOPS $ESEA etc. My nipples get sensitive just talkin about it

Quote Tweet

Jeremy Justus

@jeremyj0916

·

Jul 3, 2021

Replying to @team3dstocks

Holy shit is drys still around? Dry ship or something like that with that scam company that just dillutes nonstop lol?

·

Nope. $AMTX was 80% ADF score. so it was still in the B setup range (80-89% score). Sexy thing about it (other than the neg BV and neg NWC bonus) was the dilution and SEXY volume forecast. It’s not every day we get a perfect reading like this.

·

U can also just search the hashtag #BearTipOfTheDay to see all my previous tips. I made sure to include tweets on every major topic traders struggle with: -technicals -risk management -volume -psychology -habits -fundamentals –dilution But legend has it we dont help new traders

·

Yes, the twitter keyword search feature is its most powerful tool in my opinion. Just type in the person’s twitter handle & the keyword u’re looking for (volume, dilution, risk etc) & u have access to a library of knowledge. As I said, those who really want answers will find them

Quote Tweet

Harry Hoss

@snipertrader21

·

Feb 22, 2019

Replying to @team3dstocks

Hahahahahahahaha “From:team3dstocks supply and demand” how many fucking times have I typed that in at 1am in the morning or any other question before finally getting consistent????????

5

7

39

u have to type: FROM:TEAM3DSTOCKS followed by the keyword. So if u’re looking for tweets about volume just type: FROM:TEAM3DSTOCKS VOLUME if u’re looking for tweets on volume OR dilution, type: FROM:TEAM3DSTOCKS VOLUME OR DILUTION This feature has always been here

$YTEN The warrants are just the icing on the cake. That’s why many stocks with zero dilution can get destroyed from pure bagholder selling alone. Also, most dont quite understand how warrants work. They’re not just instant dilution soon as the stock reaches the exercise price.

Quote Tweet

ShortNinja

@shortninja4

·

Sep 10, 2020

Replying to @team3dstocks

plus all those warrants at $8.

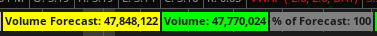

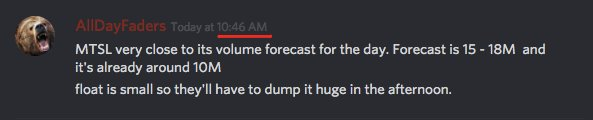

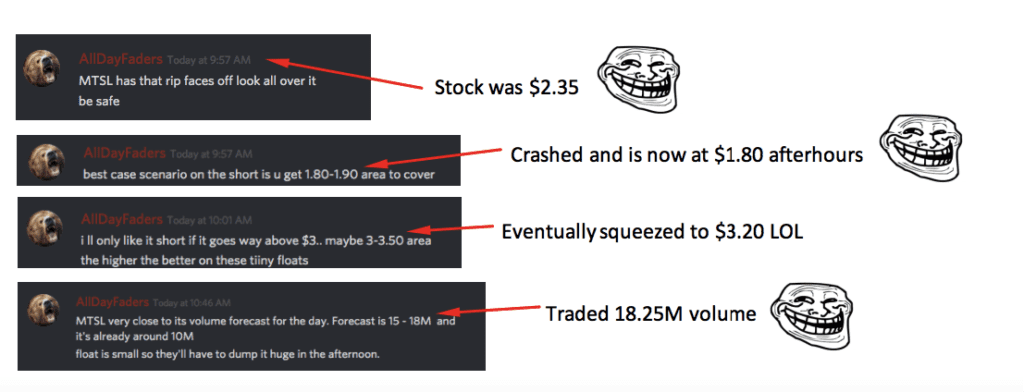

Taking a quick peek at low float land. If shorting $MTSL , use 2.76 to 2.85 area as your risk. As always, stay on guard and add to starters only on confirmation. Take profits on washes, b/c float is tiny, no dilution, and they can’t raise. So very easy to soak & squeeze. GL

·

Replying to

$MTSL Damn I was wrong on the timing. After the squeeze, they were supposed to dump it “huge” in the afternoon, not at 11:45am . Gonna punish myself for this bad call. No $XVID tonight.. only $RTUBE Nice volume forecast though ; )

·

$MTSL Knowing what the ppl in control of a stock will do is the easy part, especially when u understand the fundamentals & liquidity (volume) constraints they HAVE to obey. The hard part, is riding the wave long & flipping short at the top. The dream of every trader. #OneDay

2

6

20

·

some $MTSL commentary porn. Dont worry though, I would’ve completely missed that entire fade anyway. I was off on the timing (fade was supposed to happen in the afternoon, not this early). Goes to show how u can have all elements down and still fail. But trading is easy right?

See new Tweets

Conversation

·

Replying to

Ty for sharing bro

1

·

Replying to

“unroll”

1

·

Replying to

Hello, there is your unroll: Thread by

: “Taking a quick break from charting/data tracking to answer some questions. Last time i did a poll, the top vote was for […]” https://threadreaderapp.com/thread/1053446935212949504.html… Enjoy 🙂

Thread by @team3dstocks: “Taking a quick break from charting/data tracking to answer some questio…

·

Replying to

GIF

1

·

Replying to

Thanks for sharing

1

·

Replying to

thank you for sharing!! love it

1

·

Replying to

1

·

Replying to

Thanks brother.

1

·

Replying to

This was fantastic, thanks!

1

This Tweet was deleted by the Tweet author. Learn more

·

Replying to

and

holy shit bro lol

2

xxxxxxxxxxxxxx

See new Tweets

Conversation

·

Taking a quick break from charting/data tracking to answer some questions. Last time i did a poll, the top vote was for Volume analysis & how i use it in my trading. This is impossible to answer in a few tweets, bc volume is SO crucial to my trading, but ill try 2 keep it short

25

171

524

·

as u all know, the ONLY goal i have when i pull up a stock, is to answer ONE question: is there a supply/demand imbalance? Period. Everything I use (ADF score, volume forecast, fundamentals, L2, MAs, Ebony & Ivory etc) is to answer that ONE question. Is there an imbalance?

3

22

·

stocks go up bc buyers who use market orders & swipe the offer (demand) are more AGGRESSIVE than sellers who use market orders to slam the bid (supply). It’s literally that simple. WHO wants the stock the MOST? who wants to be filled IMMEDIATELY & doesnt wanna sit on the bid/ask?

1

9

148

·

So if a 1M market buy order is sent at the SAME time as a 5M market sell order, WHAT do u think the stock’ll do? its PURE math. the 1M buy order will get filled, but u’ll be left with 4M shares (from the seller), that has NOT yet filled (an imbalance). so what must the seller do?

1

6

135

·

The seller must now slam the bid in order to get filled. 50K at $5. another 50K at 4.90, another 50K at 4.80. another 50K at 4.70 etc. Since no one is market buying into his order, he HAS to step down and take out bids, lowering the price on the L2 each time.

1

5

142

·

What does that have to do with volume? If a stock is forecasted to trade 10M shares today (demand, in theory). But there are 20M bagholder shares that wanna get out. plus 10M from dilution in the filings. thats 30M potential supply, vs only 10M demand. the stock WILL fade ALL day

4

12

171

·

That’s why stocks with HEAVY dilution in the filings get crushed so hard, and are my FAVORITE all day faders. There are TOO many shares trying to hit the market (supply), but not enough demand (volume) to support it (unless institutions step in w/ their big dicks & absorb it all)

2

10

152

·

To give u an idea of how HARD it is to unload shares, it takes on average TWENTY minutes to unload just 1M shares, on a lowfloat stock w/ shitty volume. that’s TWENTY fucking minutes of slamming the bid 50K shares per minute. do u realize how crazy that is? how about 10M shares?

1

12

151

·

On top of that, the HUGE seller has to compete for bids with who? u guessed it. SHORTSELLERS. that are ALSO slamming the bid or clogging the Ask. wait, that’s not it, who else is selling? BAGHOLDERS trapped from months ago. ALL competing for thin shitty bids. See where im going?

1

6

136

·

That is what u call a supply/demand imbalance. Too many shares trying 2 hit the bid, not enough volume to absorb it all. So the stock flushes, & the people who bought the falling knife are ALSO bagged, & have to ALSO turn around & slam the bid. it’s a perfect cycle. An alldayfade

2

7

144

·

Thats why when the volume forecast is too high, i ALWAYS say “WAIT for demand to peak”. Im WAITING for buyers to stop slamming the offers (they dont have infinite BP). im WAITING for trapped shorts to finish covering. ONCE that happens, demand is GONE, & all thats left is SELLERS

2

18

148

·

That’s how bubbles end. That’s how stocks peak. that’s how trends reverse. why did Bitcoin top? after our grandmas & cats/dogs were done buying, who was left to buy? who was left to slam the offer? NOONE. Bunch of sellers, ZERO buyers to sell to=everyone has to slam the bid=fade

2

5

148

Anyway there is SO much more to this but I have 2 get back 2 charts & put the lil one 2 bed. In conclusion, if u’re short, look for PEAKED/weak volume, vs a TON of supply (dilution, bagholders, shortsellers etc). That is the holy grail of my trading: Supply/Demand imbalance. GL

·

Replying to

Overwhelming feedback on the #ADFVolumeAnalysis thread. Glad it helped. Once u UNDERSTAND s/d imbalance, there’s no more guessing, no more blowups, no more FIGHTING against strength. It keeps u disciplined, makes u RESPECT the market, & gives u a MATHEMATICAL approach to trading

4

9

134

·

You also now see why Im EXTREMELY careful & use bitch size or tight stops on stocks with either: 1-high inst interest 2-thin floats 3-few bagholders 4-little dilution 5-forward looking news Historically, those factors led to my LARGEST blowups, & also the LARGEST squeezes

5

29

172

·

That doesnt mean i DONT short those. im a greedy cunt & get FOMO too. it simply means I start TINY, and i WAIT for confirmation. if the demand is weak, THEN i add size. but if i start & it begins to do fuckboy shit, ADIOS amigo. Im gone. Let others get run over & come back later.

2

9

128

·

i just gave u guys YEARS of information learned thru ENDLESS blowups, ENDLESS sleepless nights tracking data & reviewing charts, for FREE!! Some of my friends HATE when I do this but fuck it. I love this community & that’s the info i WISH i knew when i started. GL #BackToMyLab

A stock doesn’t need bagholders to give you an all day fade… they just drastically increase the setup’s odds. Same thing with dilution. It’s not needed, but it helps if it’s present (in addition to the other factors). summary, never put all the emphasis on just ONE factor.

Of course you do. It only takes 1-3 minute max to spot relevant dilution. So even as a long biased trader, u have no excuse not to check filings. If 2 stocks pop up on your scanner, same technicals, one has a fat ATM or can raise anytime, one cant. Which one would u rather long?

Quote Tweet

Luke

@ShortingTrash

·

Jul 8, 2020

Replying to @team3dstocks

If I’m trading gappers in the first 2 to 3 hours fo the day, do I need to read filings? I’m long only trader right now

Tweet your reply

Reply

·

Replying to

No , please tell him no

1

14

·

Replying to

LMAO savage as fuck

1

4

Show replies

This Tweet is from a suspended account. Learn more

·

Replying to

and

search the latest 10Q for keywords. ctrl+F i think. sales agreement , atm, at the market, options, warrants, convertible check for effect fillings and see if they already issued the shares they could persuant to the fillings of that effect.

1

More Replies

·

Replying to

What about tracking data ? I’ve tracking data now for two months and monster of a spreadsheet I created is fucking bitch to fill out every night . I read an old post of yours that said track stocks that run and have offerings and track those that run and don’t have offerings ….

1

1

·

Replying to

and

…and also to jot down 5 things that happen before a stock breaks out or collapses , but god damn there’s so much to track. Any advice on how to track data more efficiently ? Do you automate your data tracking ? Do you incorporate filings into your data tracking?

Even when i do fundamental analysis on lowfloat trash, im not looking for valuations. We all know they’re worth $0. I dig the filings to find dilution/overhead selling pressure (supply) relative to volume (demand). That imbalance is all i care about. Fuck bias. #bearTipOfTheDay

Quote Tweet

AllDayFaders

@team3dstocks

·

Feb 13, 2020

$TSLA The market doesnt care about valuations. Only thing that matters is the amount of cash in circulation. Remember that Tulips once sold for over 6 figures in today’s dollars. The value of something is determined by how much people are willing to pay for it. #BearTipOfTheDay twitter.com/StockGravity/s…

·

2- Doomed to fail Dumb money are only patient when they’re losing. In short, they take profits on winners WAY too fast, but hold on to losers WAY too long. small winners, HUGE losers. Smart money spend little time on losing trades but milk the FUCK out of winning trades.

6

23

320

·

3 – Always late to the party Dumb money buy the highs of parabolic moves and sell the lows of capitulations. Smart money does the EXACT opposite & take profits (or short) at the top of breakouts & buy the bottom of panics. Simply put, dumb $$ fill the orders of smart money.

4

12

216

·

And this brings us to point 4 4 – Balance For every buyer there must be a seller. This is common sense. Supply vs Demand. Therefore, smart money & dumb money CANNOT be on the same side of the trade. If EVERYONE is long, THEY ARE SHORT. if EVERYONE is short, they MUST be long

2

12

196

·

This is SO simple yet so many ppl fail to grasp this: It’s not about being right on the direction of the stock, it’s about being on the RIGHT team. B/c u can be right about the direction, but if dumb $ joins u on that trade, smart $ HAS to move the stock in the opposite direction

4

14

191

·

5- Indicators & timeframes Dumb use small timeframes & endless indicators Smart use large timeframes & few indicators (the big picture) Dumb focus on price 1st. Smart focus on volume & liquidity 1st, price 2nd. b/c they know that price cannot move without volume

5

30

250

·

An example of this can be seen in the type of questions smart vs dumb money ask themselves when looking at a stock Dumb : “what’s the price? what’s my beef jerky indicator doing? what about the superswole indicator? what’s that one doing? fuck it the stock is going up, im in”

5

8

134

Meanwhile Smart looks at the same stock & ask: who’s currently long the stock? who’s short? who’s trapped with size & is most likely to panic or get margin called? how much demand is on the bids & below? how much supply (or dilution) can be expected? what’s the avg range? etc

Tweet your reply

Reply

·

Replying to

Now of course, smart money also has access to inside information and a bunch of other shit that YOU or the avg joe doesnt have access to, so that gives them an “unfair” advantage. But that’s PRECISELY why ur job is to simply follow their footsteps and stop trying to be a hero.

3

8

157

·

Anyway I promised i’d stop at the top 5 facts, so the thread ends here. I can share the rest of the differences between the 2 groups, but those 5 differences are the most drastic. So study yourself & ALWAYS make sure u’re not the sucker at the poker table #BearTipOfTheDay

12

9

324

You also now see why Im EXTREMELY careful & use bitch size or tight stops on stocks with either: 1-high inst interest 2-thin floats 3-few bagholders 4-little dilution 5-forward looking news Historically, those factors led to my LARGEST blowups, & also the LARGEST squeezes

·

Which is why i never long lowfloats, unless they have no shelf & no ITM dilution. I warn constantly about that but hey folks never listen until they get bagged. Now to be fair, intraday offerings & shelf announcements are extremely rare, but idgaf. I refuse to take that chance.

Quote Tweet

Will

@SlamTheBid

·

Jun 5, 2020

Replying to @team3dstocks

Til the S-3 hits

Almost caught up wih july/august DMs. Guys, too many of these questions have been answered before thru Tweets, threads, charts, REAL-TIME analysis of plays, doodles etc. Just use the twitter search tool or search my hashtags. Answering the same questions over & over is draining

Tweet your reply

Reply

·

Replying to

For the 1000th time, For lowfloats, all I care about is: -fundamentals (mainly dilution, news, share structure etc) -technicals (mainly volume, L2/tape & MAs etc) -psychology (sentiment, who im up against etc) to gauge if supply will be higher than demand (volume forecast)

2

20

67

·

The combination of those 3 things is the foundation of my ADF score, which is simply how I rank my setups. Extremely high ADF scores mean extremely high supply/Demand imbalance, so conviction goes up and I risk more ONCE I get my entry signals. Low scores = size down or avoid

2

10

42

·

Than I wrap everything up in a risk management whole wheat Tortilla.. Example of my risk mgt rules are: -Never arguing against price action -trade only setups u TRACKED & can NAME -starter size ALWAYS & final adds ONLY if ITM -NEVER renegotiating stopout levels #BearTipOfTheDay

3

15

98

·

Finally, for Options (Largecaps) all I care about is mainly: 1) Volatility (range). I need shit that’ll move big and FAST. no time for choppy bullshit 2) Technicals (Pivots, MAs, order flow, gaps etc) and of course $SPY which does 80% of the work for me #BearTipOfTheDay

·

It depends on the context. Options vs lowfloats. Options, if stock is $300: ATM – at the money contracts (the $300 puts) ITM – in the money (the $305 puts) OTM – out of the money (the $290 puts) Lowfloats ATM – “at the market” offering. Referring to a type of dilution

·

Going through my usual weekend routine (cleaning up the inbox/catching up on DMs etc.) & almost every question this week is on the same topic (fundamentals & faders), so im going to post a thread to answer this again. Grab some cofee & let’s begin. Get ready to have feelings hurt

6

9

96

·

Recently, as most have already noticed, people have been going around teaching absolute GARBAGE about fundamentals & filings. Teaching things that are 100% flat out WRONG. Sure enough, newer traders who dont know any better & trusted these ppl, blindly followed, and got WRECKED.

1

2

38

·

Which is why I get so enraged when ppl who have NO CLUE what they’re talking about, try to TEACH, instead of LEARNING first. Everyone wants to be a teacher these days even when they’re NOT ready, without even realizing that their mistakes are costing people MONEY and BLOWUPS.

1

2

36

·

No, a shelf is NOT an instant ATM that can be dumped at anytime. No, an EFFECT doesnt mean it’s TIED to the most recent S3 u carelessly skimmed. No, just b/c a company has warrants at $3 doesnt mean they can just use em. No, just b/c a company has an ATM doesnt mean its relevant

2

11

55

·

Yet, ppl are being taught this trash, and when they lose $$, they try to blame fundamentals. Just b/c everyone has access to filings doesnt mean everyone is USING THEM CORRECTLY. that’s like saying “everyone has access to charts & technical analysis so price action doesnt work”.

1

2

32

·

Fundamentals must be used CORRECTLY. just like Technicals must be used CORRECTLY. If a stock drops to support and DOESNT bounce, does that mean Technicals no longer work? Yet when a stock with so called “dilution” upticks 3 cents, everyone panics OH MY GOD FUNDAMENTALS DONT WORK.

1

3

33

·

Do u see the flaw in that logic? There is ZERO competition b/w fundamentals & technicals. one is not better than the other, b/c they serve 2 COMPLETELY diff purposes. One lays the ground work for the thesis, & AMPLIFIES the technical setup. The other is for CONFIRMATION & TIMING.

2

3

41

·

When the 2 are in agreement, the price move is amplified. when they are not, u get CHOPPY action/the reverse. An examp of this is when ppl see a 5M ATM (supply) & rejoice. “yay it’s gonna fade”. Yet they COMPLETELY ignore the 50M volume(demand). That is NOT a supply imbalance!!

1

6

44

Or when ppl see a huge supply overhang (warrants/converts etc), & think “YES, THERE IS DILUTION. max BP baby lets go”. yet they ignore the part that says that those CANT be exercised yet, have a lockup period, or are part of a PIPE that’s not even registered yet. The list goes on

Tweet your reply

Reply

·

Replying to

Conclusion, anything used WRONG will backfire. Dont blame the car,blame the driver. On in today’s “everyone is a teacher” bubble, blame the driving instructor. Trading is SERIOUS. this shit takes WORK. u’re not gonna half ass it & expect great results. KNOW who u’re learning from

1

6

43

·

and i dont wanna hear that “no one is teaching it” BS. There are a TON of LEGIT ppl teaching this shit out there, in vids, books, articles, DMs etc. most are just not looking hard enough b/c they’re attracted to marketing crap like shiny PNLs & fancy cars. FILTER the noise. GL..

9

4

60

·

DM: “ADF what makes u think it was dilution on that -70% day. it couldve just been technical sellers” $RSLS on October: “we have a $15M ATM” RSLS this week: “we sold 3.58M shares since Nov 25 through our ATM “. How much more proof do u need? #TheLevelOfDenial #IsMindBoggling

Quote Tweet

AllDayFaders

@team3dstocks

·

Nov 26, 2018

$RSLS -70% intraday drop. i remember I used to get so much heat for preaching the importance of fundamentals, filings, dilution etc. They would say “forget fundies, it’s all about the chart”. Yeah go tell that to the guys who kept buying $RSLS at “chart support”. #DilutionCity

·

The key factor when it comes to all day faders is and will always be ITM dilution. Keep in mind that this is always relative to the stock’s volume. 5M dilution means nothing if volume is 100M. That’s where ppl fuck up b/c they look at supply but ignore demand #BearTipOfTheDay

5

18

96

If there is no dilution, then most of the selling will obviously come from bagholders and profit takers. The more overhead resistance (from previous big volume days, followed by VERY low volume days), the more bagholders. And the more extended the stock is, the more profit takers

Tweet your reply

Reply

·

Replying to

Dont count on shortsellers to provide most of ur supply. In fact most of the best faders ive seen, tracked & traded had the LEAST amount of shorts on that day. The more shorts involved, the more covers on the way down. slows down the descent. leads to cunty/choppy fades.

4

6

55

·

A stock doesnt need dilution to fade. It’s just a “bonus”, and can also be completely irrelevant depending on how much volume the stock is capable of trading (example a $5M ATM means nothing if the stock trades $150M volume). That’s why dilution is only 1/5th of the ADF score.

Quote Tweet

afghanrebel

@Afghanrebel

·

Dec 19, 2020

@team3dstocks hey bro, a trader inboxed me asking how come you had high adf score for $ssnt cuz it had no dilution etc. It was a good question and got me very curious, was it news related or why high prob fade. Demand>supply given float & no overhead?

I wish bro. if I could automate the ADF score using TOS my life would be complete. Only issue is 2 of the 5 categories that make up the score (1 being amt of ITM dilution) require human analysis & a basic understanding of Fundamentals. And sadly TOS doesnt provide dilution data

Quote Tweet

Shaka

@__shaka_zulu__

·

Dec 14, 2020

Replying to @team3dstocks

Are you thinking of integrating the ADF score into TOS or are sticking to just volume forecast on the charts?

·

Replying to

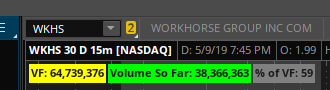

$WKHS demand was absolute trash in the morning and all day. only traded 59% of its volume forecast. combine that with the high ADF score and massive dilution = the usual all day fader. same shit different day. hope this helps GL.

2

3

6

·

$RSLS -70% intraday drop. i remember I used to get so much heat for preaching the importance of fundamentals, filings, dilution etc. They would say “forget fundies, it’s all about the chart”. Yeah go tell that to the guys who kept buying $RSLS at “chart support”. #DilutionCity

1

3

50

·

I tried to smash friday’s record so i could call out

again and yell “wHo wAnTs tHe sMoKe”, but there seems to be dilution, #vwapBoulevard and a hidden seller at 18-19K area . #letMeBeGreatbro

1

3

43

·

Great Q. As mentioned b4, the volume forecast application is completely different when dealing with small vs largecaps. For lowfloats it helps anticipate direction (up or down), due to their illiquid nature. For largecaps (already liquid) it helps anticipate intraday RANGE.

Quote Tweet

TradeNet88

@TradeNet88

·

May 22, 2019

Replying to @team3dstocks

Is vol forecast as useful with big gaps as with small caps? Do you use it exactly same with both?

2

10

45

Example, a strong volume forecast on a lowfloat (assuming no crazy dilution) will lead to an intraday squeeze, well over 90% of the time. But a strong VF on a largecap like $TSLA etc simply mean we’ll get above average range today, regardless of direction. Those days are the BEST

·

1/2 Manipulating a stock requires 1st building MULTIPLE positions in it. One to obviously make a profit, another to increase interest & dollar volume (via scalping), and Short positions to 1) allow them to keep shorts trapped without ruining their own average 2) hedge their risk

Quote Tweet

AllDayFaders

@team3dstocks

·

Feb 22, 2019

It doesnt matter how much conviction I have on a setup. The MOMENT I see volume OUTSIDE the alldayfader range, it is time to BAIL & revisit when demand peaks. U NEED shitty volume for SUPPLY to take over. Stock manipulators NEED volume to execute their operations. It is MANDATORY

Show this thread

2

10

60

and 3) keep the stock around desired price ranges (for various reasons). That is why volume is SO critical for their operations. They need it for liquidity, dilution, & to circumvent certain SEC regulations. It is their lifeblood, LEARN the ins & outs of it. #BearTipOfTheDay

Tweet your reply

Reply

·

Replying to

They ONLY build those positions when their goal is to squeeze the stock far above the AM range, NOT when their goal is 2 simply dump shares right at the open (clean ADFs). That is why a stock they’re planning to squeeze will reach its EOD volume forecast WAY before the usual time

5

44

·

Focus on REAL supply. so just look for dilution that can actually hit the open market. So: -ATMs (my absolute fav) -In the money or near the money warrants -Convertible notes -Convertible preferred -Huge insider positions from prior PIPEs or pub offerings etc #BearTipOfTheDay https://twitter.com/BreakRude/status/1273904328869326848…

This Tweet is from a suspended account. Learn more

1

12

60

·

And always remember that dilution should always be looked at relative to VOLUME. I see too many folks get excited over 1M shares worth of dilution (supply) while ignoring the 100M volume (demand). Dilution means nothing if there’s more than enough volume to soak it all up.

1

5

37

But when u combine massive dilution with pussy volume, the stock has a 99.9% chance of being a all day fader. The only challenge now becomes finding borrows and most importantly, getting filled. B/c trust me, there’ll be so much supply that u’ll be lucky to fill half ur max size

Tweet your reply

Reply

·

Replying to

Unroll

1

·

Automated

Replying to

Hi! Your thread is ready to read. Focus on REAL supply. so just look for dilution that can actually hit the open market. So:-ATMs (my https://rattibha.com/thread/1275057074775433217?lang=en… Have a good day!

·

Replying to

Hey there, i appreciate the great info on this page, i am new to trading and i am wondering if this all day faders have always existed and behaved the same, or it is only because of the current bear market?

·

I tweeted at 3:32pm yesterday that i wasn’t interested in $EQ b/c of its low ADF score (only 76%) and its super high volume relative to its forecast. Which means u step back & let shorts get squeezed first. 3min after that tweet it squeezed to $30. Shelf is not everything.

Quote Tweet

waiting

@BangCapTrading

·

Jul 14, 2020

Replying to @team3dstocks

went to the mooooonnnn . They didn’t need cash . Shelf doesn’t matter. In this case

GIF

ALT

2

9

also due to abundant misinformation, most have no clue how a shelf works . They think just b/c a stock has a shelf = instant intraday dilution. They confuse “shelf” with ATM. those are 2 completely different things. I have a whole tread explaining the difference.

Tweet your reply

·

Focus on REAL supply. so just look for dilution that can actually hit the open market. So: -ATMs (my absolute fav) -In the money or near the money warrants -Convertible notes -Convertible preferred -Huge insider positions from prior PIPEs or pub offerings etc #BearTipOfTheDay https://twitter.com/BreakRude/status/1273904328869326848…

This Tweet is from a suspended account. Learn more

1

12

60

And always remember that dilution should always be looked at relative to VOLUME. I see too many folks get excited over 1M shares worth of dilution (supply) while ignoring the 100M volume (demand). Dilution means nothing if there’s more than enough volume to soak it all up.

Tweet your reply

Reply

·

Replying to

But when u combine massive dilution with pussy volume, the stock has a 99.9% chance of being a all day fader. The only challenge now becomes finding borrows and most importantly, getting filled. B/c trust me, there’ll be so much supply that u’ll be lucky to fill half ur max size

·

Replying to

Unless there’s heavy ITM dilution or a huge BBOD, stocks rarely break support without offering a bounce shortly after. So it’s always safe to wait for the retest.

1

1

4

·

Replying to

No, freedom price = price they need to close above to be free from baby shelf (read up on how dilution works)

2