UNDER A TRADING REHAB !!

I AM UNDER STRICT REHAB RULES UNTIL I PROVE CONSISTENCY

REHAB RULES:

1. TRADE TWO SETUPS ONLY.

2. DO NOT TOUCH ANYTHING THAT IS NOT AN “A” SETUP

3. GET OUT OF POSITION AT THE FIRST SIGN THE TAPE IS AGAINST YOU OR IF YOU FIND OUT YOU MADE A WRONG ENTRY. NEVER MAINTAIN A POSITION HOPING.

4. IF A STOCK IS NOT GOING IN THE RIGHT DIRECTION WITHIN 5 MIN OF YOUR ENTRY, LEAVE THE POSITION AT FIRST OPPORTUNITY.

5. MOST IMPORTANT: HAVE A CLEAR DEFINITION OF AN “A” SETUP

Summary: An 80c green day on full size. It could have been above $1, but I was too scared and played it too safe. Great hits – stock selection and fundamentals; second exit nailed. Stay focused on your game and ignore the noise.

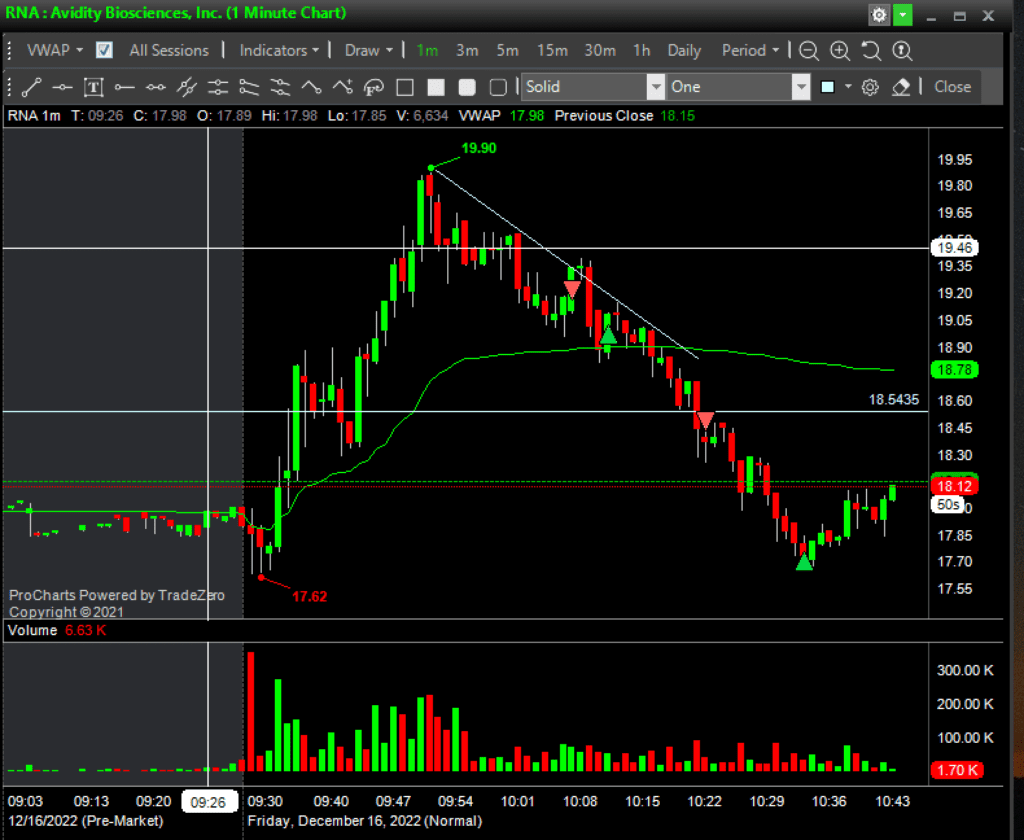

RNA

Borrow cost per share: 0.018

Short:

| 12/16/2022 | SS | RNA | 50 | $19.16 | 10:06:09 | $0.99 |

Cover:

| 12/16/2022 | BC | RNA | 50 | $19.03 | 10:10:44 | $0.99 |

Stoploss: 19.50

Target: 18.50

Expected R/r: 2/1

Actually tolerated risk: 19.41

Profit/loss: 0.13

Actual R/r: 1/2

What did I do right:

- Market conditions – SPY was going down, so it was a good time to short.

- Stock selection – this was definitely the right stock to trade. They had just announced a new stock issue priced at $17.50. They had to push the price higher than 17.50 so the middleman can make money on the issue. It was obvious they would defend the 17.50-17.70 price for as long as possible. The stock moved not too quickly and it would give time for reaction. It kept trend nicely.

- Not a bad stop selection – 19.50. A round number area where the first lower high of the new downtrend held resistance.

- I did wait for the entry to be on an upside.

What can I improve on:

- The entry – I got scared I would miss it if the stock plunges under 19. I did wait for the first 19 support break attempt to fail and enter on the bounce, but unfortunately, I didn’t wait long enough to catch a 19.35 entry. I got 19.16 which placed me too close to the 19 and VWAP support. Because of the entry being too close to double support, I got scared I would need to close red, so I left the position and didn’t wait for the third attempt on the support break. With a higher entry, I would have the space to wait out for the third support break attempt to work and then hold until 17.70 for $1.46 profit per share.

Comments: I was too scared at entry that I would miss the train, therefore I got in too early. If I had waited just a minute, I would have been able to enter at around 15-20c above. Then, because of an entry too close to the VWAP, I got even more scared I would go red on this one and sold at minimal profit. A better positioned entry would have resulted in $1.46 profit.

Main take:

- Watch for good timing market conditions

- Keep the good work on stock selection

- Fundamentals are key – the understanding of how the agent would manipulate the price to be able to make money was crucial

- Excellent exit – trust your judgment on it

- Earlier identification of the right entry and patience with it would pay off.

- Key levels matter – round numbers, VWAP – I must expect the price to bounce off these and take some time to break them.

- The stock new issue was preceded by fluffy news on phase one positive results and two price upgrades by Credit Suisse and Raymond James. Watch for news manipulations like these to predict new issues.

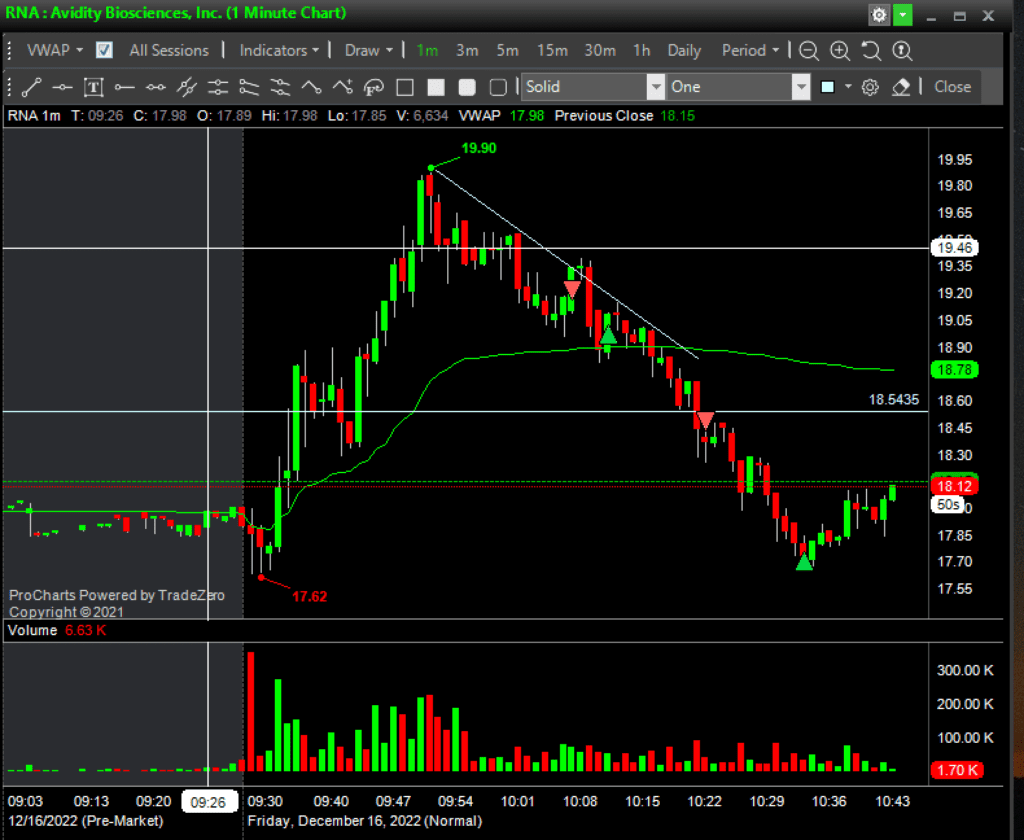

RNA

Borrow cost per share: paid on first transaction

Short:

| 12/16/2022 | SS | RNA | 50 | $18.43 | 10:21:11 | $0.99 |

Cover:

| 12/16/2022 | BC | RNA | 50 | $17.76 | 10:32:31 | $0.99 |

Stoploss: 18.55

Target: 17.70, ideally 17.50

Expected R/r: 10/1

Actually tolerated risk: 18.47

Profit/loss: 0.67

Actual R/r: 16/1

Comments: Stop was a bit too tight. The entry again was too low. I could have entered around 18.70 once I saw it holding it as a resistance for 2-3 min. The stock was in a liquidation mode with space to 17.70 are, so here I was absolutely right to enter.

I was again really scared throughout the hole trade since the stock changed the trend trajectory making it a bit steeper, therefore leaving room for a more serious bounce. At around the 17.70 area, the 5 sec behaviour changed and this was a signal for me to close, right on time! We also had 17.62 as the low of the opening range, so everything lined well there.

The stock gave up the 17.60 support later on and bottomed at around 17.30, but I did get the meat of the move.

Main take:

- Great exit

- Congrats for entering second time on this one!

- The entry could have been a bit higher.

RNA might give more opportunities on Monday. We had 2 inside days already.