UNDER A TRADING REHAB !!

I AM UNDER STRICT REHAB RULES UNTIL I PROVE CONSISTENCY

REHAB RULES:

1. TRADE TWO SETUPS ONLY.

2. DO NOT TOUCH ANYTHING THAT IS NOT AN “A” SETUP

3. GET OUT OF POSITION AT THE FIRST SIGN THE TAPE IS AGAINST YOU OR IF YOU FIND OUT YOU MADE A WRONG ENTRY. NEVER MAINTAIN A POSITION HOPING.

4. IF A STOCK IS NOT GOING IN THE RIGHT DIRECTION WITHIN 5 MIN OF YOUR ENTRY, LEAVE THE POSITION AT FIRST OPPORTUNITY.

5. MOST IMPORTANT: HAVE A CLEAR DEFINITION OF AN “A” SETUP

Summary:

Main lesson for the day

What can I turn into a system/procedure/habit/tool so I save time and eliminate decisions?

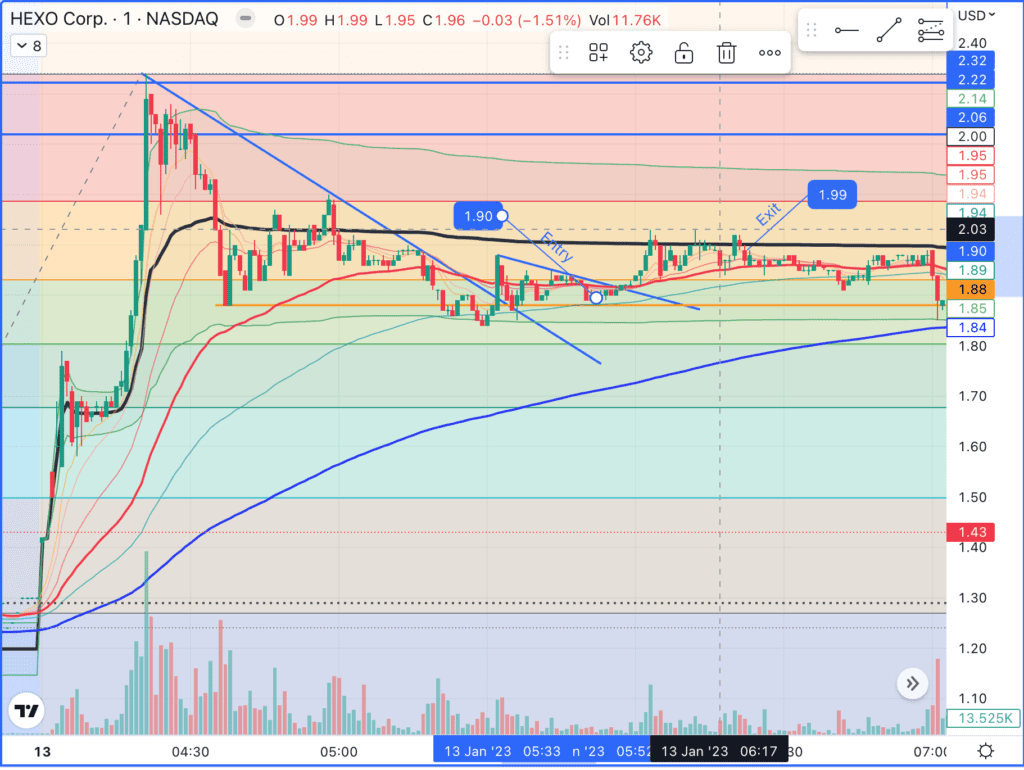

Profit of 9c/share. Could have cashed 12-13. Entry at confirmed support after a broken downtrend. Exit too late, at resistance. I got lucky here. Ticker: HEXO

Long:

| 01/13/2023 | B | HEXO | 30 | $1.90 | 05:52:38 | $0.99 |

Sell:

| 01/13/2023 | S | HEXO | 30 | $1.99 | 06:22:05 | $0.99 |

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take:

Profit of 9c/share. Entry at confirmed support, exit at obvious resistance, what more can I ask for? Maybe to learn to exit on the volume spikes… Ticker: JSPR

Long:

| 01/13/2023 | B | JSPR | 30 | $2.16 | 08:47:56 | $0.99 |

Sell:

| 01/13/2023 | S | JSPR | 30 | $2.25 | 08:52:06 | $0.99 |

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take:

Ticker:

Long:

Sell:

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take:

Ticker:

Long:

Sell:

Stoploss:

Target:

Expected R/r:

Actually tolerated risk:

Profit/loss:

Actual R/r:

Comments:

Main take: