Small Caps are running big time again

How long would this run last having in mind that we are still in a bear market, no one knows. It might last another week or two. The excitement is quite high. I wouldn’t be surprised if the small cap excitement transfers over to the large cap world and sets a bottom for the bear market.

Friday runners

$AMAM

Free float 39M; Biopharma; Losing; 50% IO (institutions owned); Dilution $100M/year

61 times Relative Volume on Friday! The stock halted a thousand of times in both directions, really difficult to trade it safely. A huge short squeeze going from $0.38 to $4.54 in one day. It run on this news:

This move follows a key announcement from the company around data released for its breast cancer drug ARX788. Early safety and efficacy data suggest that patients who are resistant or refractory to tucatinib-containing regiments saw a 100% disease control rate (DCR) and 51.7% overall response rate (ORR).

Overall, these numbers are very impressive. These sorts of data suggest that the company’s research and development process has resulted in what could be a big winner.

It is quite possible that it continues going up parabolic on Monday and Tuesday.

I am waiting for a significant decrease in volume and a major resistance level or a VWAP boulevard rejection to go short. It might not come on T+1 or not even on T+2.

$MOMO

Free float 150M; a China-based, social entertainment company; Profitable; Losses only in 2020 and 2021; 70% IO

Run big and held on Friday, Relative Volume 20 times. $8.85 was a key support area with $9.10 being a key resistance in the afternoon.

It ran on earnings and a Morgan Stanley upgrade and a new price target of $9.

With the heating of the small cap market, it might run a third day before giving up. I want to see a pop and rejection off $10 on Monday morning and a break of the uptrend or at least of the $8.85 support area, break it and turn it into a resistance with volume going down to consider a short.

Or, being owned by institutions at 70%, we might not see any significant selloffs, just a range trading for days.

$CLRO

Free float 12.5M; Network streaming solutions; Losing around $8M/year; 5% IO; Dilution around 10M/year; Multi-day long red candles; I don’t like the price (below $3) and the float (on the low side)

Dilution HIGHLY PROBABLE. I don’t see recent dilution, yet they need it annually.

Ran on this news on Friday:

ClearOne Inc. shares more than doubled to $1.88 on Friday after the company said it reached a global settlement with Shure Inc. for all pending legal disputes.

The company said the terms of the settlement agreement is confidential.

ClearOne and Shure have agreed to file dismissals with prejudice in all pending cases to fully and finally resolve their disputes. Both companies have agreed to release the other party from all claims and to cross-license all patent rights involved with the cases, such that each party will be free to sell their products without restrictions going forward.

66 times Relative Volume! Did not hold well, critical support is the $1.26 area. It might be done running for now.

I hope for a pop on Monday towards the 1.50, a rejection and then a break of the $1.26 support area, so I can safely go for a ride.

$PHVS

Already fading big time premarket.

Free float 22.5M; Biopharma; Losing 50M/year; Dilution 160M/year; Cash for 8-10 months on the 1st of October; 88% IO

After hours/premarket runners

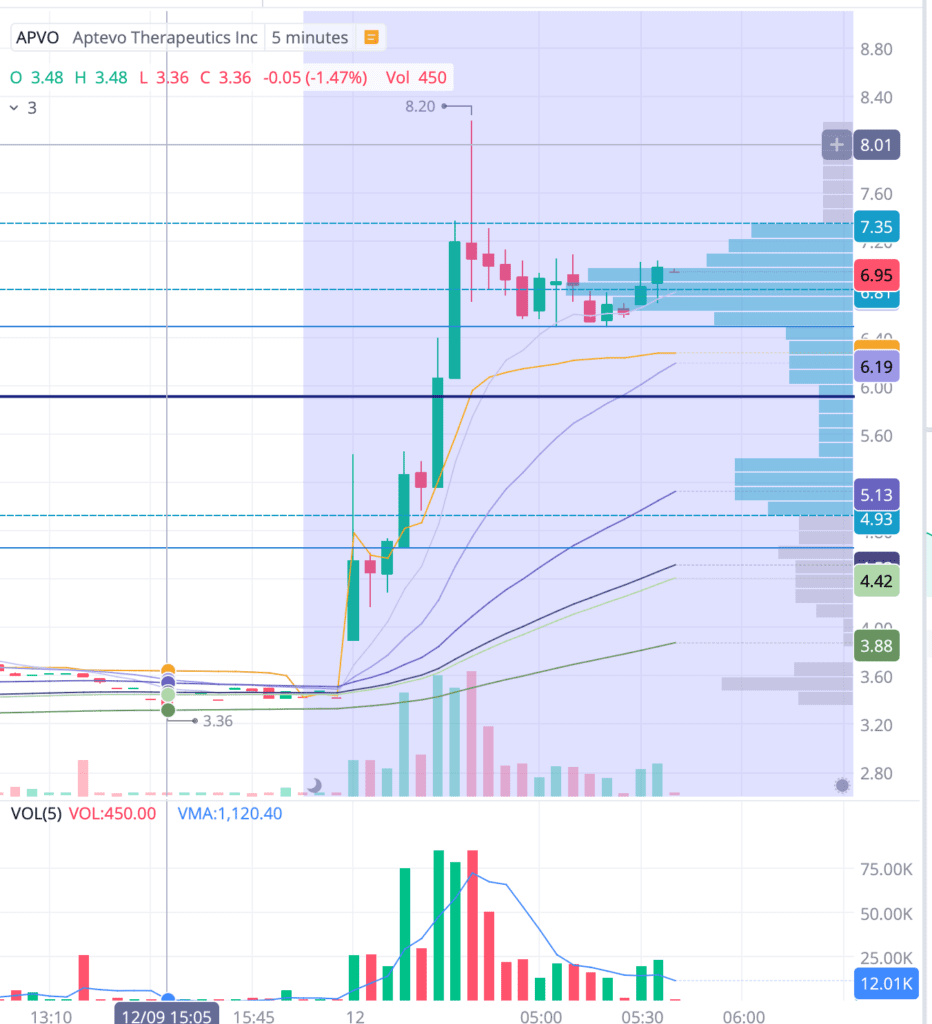

$APVO

Premarket Relative Volume at 20 times!

Free float 5M; Biopharma; Losing around $30M/year; 17% IO; Dilution around 30M/year; Multi-day long red candles;

I think it’s about to use a shelf or an ATM. As per the Balance Sheet, it had cash for 3 months in the beginning of October. Also, it has been slowly going up for the last 10 days on average daily volume of 56k.

Running on:

Aptevo Therapeutics Announced 100% Clinical Benefit Rate Achieved in Phase 1b Trial Evaluating Apvo436 in Combination With Venetoclax & Azacitidine for Venetoclax Treatment Naïve Patients With Acute Myeloid Leukemia

Support forming at $6.50, PM HOD at $8.20. 7.35 is also forming as a resistance.

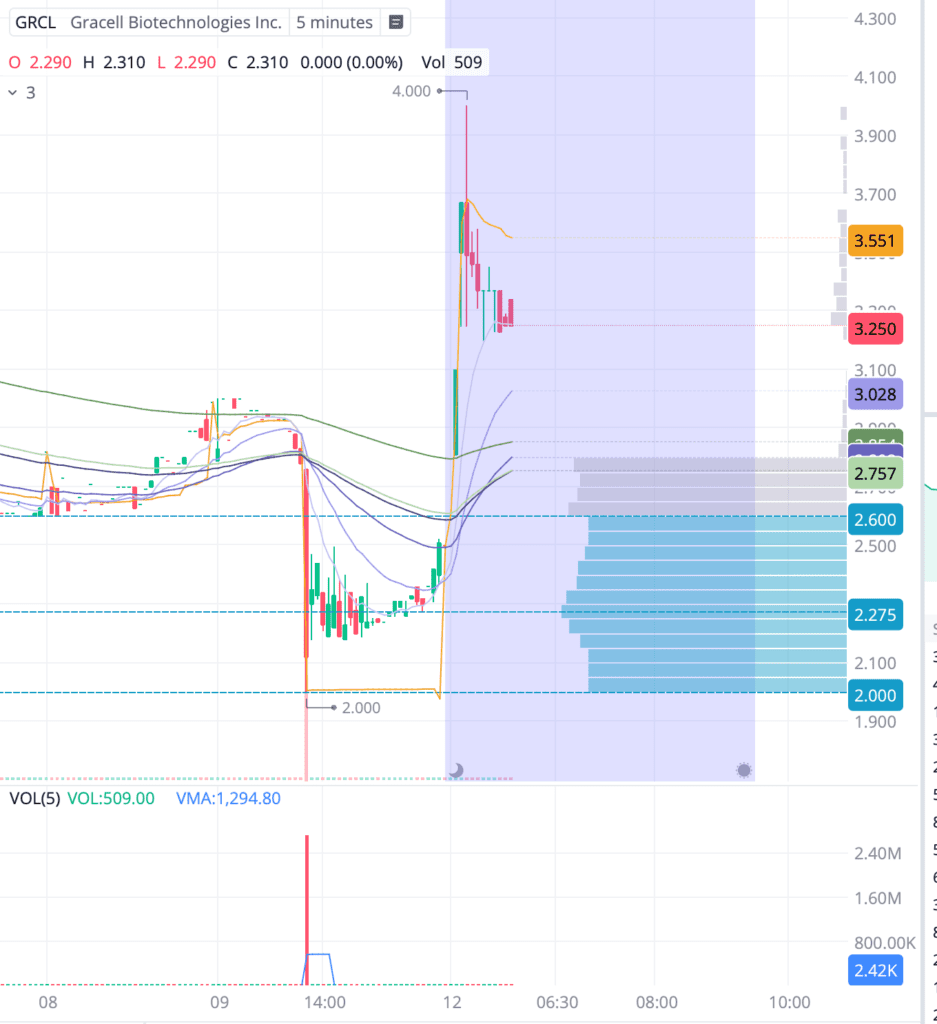

$GRCL

MASSIVE DILUTER !!!! Running on fluff from the underwriter : “Gracell Biotechnologies Initiated at Buy by HC Wainwright & Co.” plus some other presentation news

Free float 62M; Biopharma; Losing around $300M/year; 46% IO; Dilution 1B(100M)/year; Multi-day long red candles;

Daily 200EMA at 4.10. It’s already fading PM with current support at 3.20